Cobalt is used for everything from batteries and magnets to catalysts and superalloys. Its function in electric vehicle manufacture is not only critical for the future of the motor vehicle industry, but to fuel the energy transition.

In no uncertain terms, cobalt is critical to mankind’s future progress.

However, there is a problem.

And it’s a big one.

The Democratic Republic of Congo (DRC) produces 73% of the world’s cobalt and has more reserves than the rest of the world combined. Yet, to source the cobalt the DRC is accused of putting workers in slave-like conditions.

“The cobalt that's being mined in the Congo is in every single lithium-ion rechargeable battery manufactured in the world today, every smartphone, every tablet, every laptop, and crucially every electric vehicle, so you and I, we can't function on a day-to-day basis, without cobalt,” Siddharth Kara said in his book Cobalt Red: How the Blood of the Congo Powers Our Lives.

Much of the DRC's cobalt is being extracted by "artisanal" miners — freelance workers including child labourers who work in subhuman, grinding, degrading conditions. Human rights organisation Amnesty International said it estimated 40,000 children are employed in artisanal mining in the DRC.

These workers employ basic tools such as pickaxes, shovels and rebars to extract cobalt from the earth, working in hazardous trenches, pits, and tunnels. This cobalt subsequently enters the formal supply chain, raising ethical questions about its sourcing.

Certainly a more ethically produced source of cobalt is required.

And more stable countries such as Namibia should be in the mix when it comes to future supply.

Celsius Resources Ltd (ASX:CLA, AIM:CLA) has 95% ownership of the Opuwo Project in Namibia.

The country takes ethical sourcing of the resource seriously. Way back in 2018, it came under the microscope with other African nations as tougher rules on child labour came into play when the London Metals Exchange launched a responsible sourcing plan after child labour fears arose.

The main culprit was the DRC, but the move saw Namibia and others get serious about protecting its children, its citizens and its economy.

Celsius has been a major player in Namibia since that time and Opuwo has the potential to become globally significant given its infrastructure and location.

More on that later, but first let’s look at how growing demand is pushing for more ethical product.

Strong demand due to weak alternatives

There is already a viable cobalt-free battery and that is lithium iron phosphate or LFP. But the main downside of LFP is low energy density and therefore driving range.

Cobalt is therefore expected to remain a key raw material for the entire battery supply chain despite the persistent theme of substitution, according to the Cobalt Institute’s Cobalt Market Report.

Cobalt demand is forecast to rise by more than 200,000 tonnes by 2030 with the market size doubling relative to 2022 and approaching 400,000 tonnes – this demand story shows a strong outlook for cobalt despite some efforts to reduce material intensity.

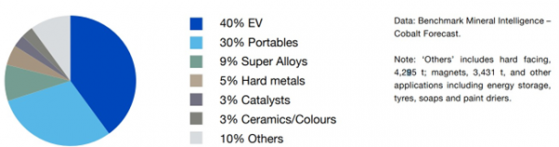

After becoming the largest end-use sector for cobalt in 2021, electric vehicles (EVs) gained further ground in 2022 and now account for 40% of total cobalt market end-use demand.

Demand share of cobalt end-use sectors in 2022.

EVs alone supported 86% of annual demand growth in 2022 while the traditional, non-battery applications accounted for just 6% of growth.

Ethical sources of cobalt supply

Growing demand for cobalt sourcing – driven by its crucial role in enabling electric mobility and the green economy – puts into the spotlight the way this critical mineral is sourced and where it is sourced from.

In 2019, BMW said it would source cobalt for EVs and batteries directly from Australia and Morocco to ensure ethical mining. Mining giant Glencore (LON:GLEN) turned its attention to the Murrin Murrin mine in Western Australia for EV production, which produced 2,900 tonnes of cobalt in 2018.

India, Australia and other nations are looking for ethical supply along with more ESG focused companies.

As we mentioned earlier, they are also looking to ethical companies operating in regions that have turned the corner in their ethical outlook to mining.

Let’s look at some of the cobalt explorers and developers outside the DRC making moves in the market.

Celsius’ Opuwo Cobalt Project in Namibia represents a potential, stable cobalt source from a non-conflict country, which could be globally significant.

Opuwo’s 259,000 tonnes of contained cobalt, the largest cobalt deposit outside of the DRC, demonstrates the potential for the project to be a significant supplier of cobalt into the battery market.

Furthermore, its 970,000 tonnes of contained copper will enhance the viability of the project given current and forecast copper prices.

Infrastructure will also play a key role in its potential success.

Next steps

More than 95% of the resource is comprised of fresh sulphide with the potential for the recovery of the shallow zone through a small to medium-scale, low-cost open pit operation.

Preliminary roasting and tank leach test work results showed encouraging results of 95% cobalt and 98% copper recovery which demonstrate that the Opuwo ore is amenable to roasting and tank leach downstream process method.

Celsius is busy at the project on multiple fronts with ongoing trade-off studies on mining costs, production rates and the possibility of processing oxide ores are being conducted to determine viability and financial outcomes.

Mining optimisation work is also underway to update the 2018 scoping study, aimed at reducing cost to support future feasibility studies.

Potential takeover target

Chinese companies refine three-quarters of the world’s cobalt supply and produce around 70% of the world’s lithium-ion batteries, raising concerns about the growing reliance on Beijing for battery metals.

The US and Saudi Arabia recently started talks to secure metals in Africa needed for both countries’ energy transitions.

The US is trying to curb China’s dominance in the electric-vehicle supply chain while Saudi is looking to buy US$15 billion in global mining stakes, according to a WSJ report.

Projects including the Opuwo Cobalt Project in Namibia could be potential takeover targets in the global race for securing stable supplies of cobalt, lithium and other battery metals.

Cobalt Blue Holdings Ltd (ASX:COB, OTC:CBBHF) is making strong progress with its integrated Australian cobalt supply strategy with work at present focusing on a refinery development program and a definitive feasibility study (DFS) for the Broken Hill Cobalt Project (BHCP) utilising results from a demonstration plant.

The strategy incorporates a refinery at Kwinana in Western Australia at which cobalt sulphate will be produced for export utilising cobalt from the BHCP in Broken Hill, Far West New South Wales.

This comes at a time of increased focus in the US and Europe on developing critical minerals supply chains to serve the burgeoning electric vehicle and clean, green energy sectors.

Corazon Mining Ltd (ASX:CZN, OTC:CRZNF) recently received further positive metallurgical test-work results from its Lynn Lake nickel-copper-cobalt sulphide project in Manitoba, Canada, where ore-upgrading presents the potential to reduce costs and increase reserves of a future mining operation.

Lynn Lake was successfully mined for 24 years before it was closed in 1976.

The ore at Lake Lynn was historically processed via conventional flotation, which delivered very good recoveries for nickel, copper and cobalt. Corazon has since achieved improved recoveries and concentrate grades compared to those historically reported.

It’s worth noting that 80% of the current resources are in the measured or indicated JORC category (total contained metal of 116,800 tonnes of nickel, 54,300 tonnes of copper and 5,300 tonnes of cobalt), with much of the resource area drilled out and ready for mining.

Aircore drill assay results released by Sipa Resources Ltd (ASX:SRI) last month month have added weight to previously-identified nickel and cobalt mineralisation at the 100%-owned Skeleton Rocks Project in Western Australia.

The exploration company completed twenty holes for 1,064 metres at the Nicoletti and Oetiker 3 prospects, with significant areas left to be tested as drilling was restricted to the paddock margins due to the target area being under crop.

“We continue to methodically explore our tenement package at Skeleton Rocks and have further nickel-copper and pegmatite targets to test once the cropping season is over,” Sipa Resources managing director Pip Darvall said.

Aruma Resources Ltd (ASX:AAJ) managing director Glenn Grayson recently spoke to Thomas Warner from Proactive after the Western Australia-focused mineral exploration company announced it has received some promising rock chip sample results from its Saltwater project in the Pilbara.

Grayson says the samples have revealed high-grade cobalt, reaching up to 0.45% cobalt, making it economically significant. Additionally, the samples contain manganese with levels of up to 40%. The project also uncovered anomalous copper and silver.

A final word

Cobalt is critical to the clean energy revolution. As interest has grown in cobalt’s properties and its myriad uses, so has the need to find ethically sourced material that minimises harm to people and the environment.

Outside the DRC there are several supply options.

From countries such as Namibia where Celsius is working hand in hand with the government to ensure safe extraction, to Australia which could be a key source of supply to the growing number of car and electrical manufacturers that require cobalt for everything from EVs to imaging equipment.

The supply-demand equation is in favour of those that have an ethical eye, abundant resources, infrastructure and locale.

Read more on Proactive Investors AU