Predictive Discovery Ltd (ASX:PDI) is closer to delivering a maiden JORC-compliant resource at its Bankan Gold Project in Guinea in the coming months following A$26.5 million in funding from an institutional placement.

Around 70,000 metres of drilling have been completed with three active rigs on-site to undertake aggressive drilling.

Its mineral resource estimate will be underpinned by two significant greenfield discoveries:

➢ NE Bankan – a 1.6-kilometre-long zone of shallow, oxide, gold mineralisation, which remains open at depth and along strike; and

➢ Bankan Creek – 3 kilometres to the west of NE Bankan, a second gold mineralised system with potential to materially contribute to the mineral resource estimate.

Much of the area surrounding Bankan remains unexplored, with significant opportunity for further greenfields gold discoveries.

Systematic auger program is ongoing, combined with the recently acquired aeromagnetic survey.

North American institutions support placement

The company’s A$26.5 million institutional placement was driven by tier-1 North American institutions and supported by existing major shareholders.

This placement was narrowly focused on a number of tier-1 North American funds with a track record of strong success investing in emerging West African gold companies.

The placement was also targeted at highly accomplished ultra-high-net worth resource investors.

“Very long runway of growth”

PDI managing director Paul Roberts said: “The strong participation by tier-1 international and domestic institutional investors, many of which have a strong track record of investing in the West African sector, reinforces our conviction that we have found a truly remarkable project at Bankan – one with a very long runway of growth ahead of it.

“The placement will enable us to commence by far the largest program that we have undertaken to date to deliver key project milestones at NE Bankan and Bankan Creek as well as test the numerous potentially high impact exploration targets in the broader Bankan project, beginning with Argo where we already have high grades in the auger over good intercepts.”

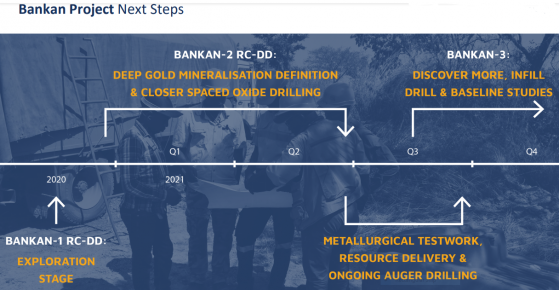

Drilling program planned

Placement proceeds will be applied to around 110,000 metres of drilling planned over the next 12 months and will also be used to deliver metallurgical test-work, the commencement of technical studies and baseline studies required for project development including social and environmental studies, and for general working capital.

The company plans to begin with testing nine high order near-regional targets on interpreted ENE-WSW faults, crosscutting a newly recognised major 35 kilometre-long NNW structural corridor with the potential to host numerous ‘NE Bankan-style’ discoveries.

These potentially high-impact targets may now be immediately followed-up, commencing with the company’s recent regional exploration success only 17 kilometres north of NE Bankan, at Argo where numerous high-value targets are already yielding widespread high-grade gold – including 12 metres at 9.8 g/t and 16 metres at 2 g/t.

Argo Regional Target (NYSE:TGT) AG1 results

PDI has enhanced the regional prospectivity of Bankan Gold Project in Guinea with new auger drilling results from Argo Regional Target AG1.

In addition, encouraging rock chip results of up to 9.48 g/t from workings northeast of AG1 highlight an additional target on the Argo permit for follow-up power auger drilling.

At Bankan Creek North, auger drilling returned results of 18 metres at 0.24 g/t gold from 4 metres and 21 metres at 0.56 g/t from 4 metres.

Results were also received from NE Bankan core holes from the northern and southern extensions of the NE Bankan gold mineralised system, but outside the core gold mineralised zone.

Results included:

- 25 metres at 0.51 g/t from 106 metres; and

- 21 metres at 1.27 g/t from 112 metres, including 15 metres at 1.59 g/t from 118 metres.

Predictive has made two significant gold discoveries within 18 months – at the NE Bankan and Bankan Creek prospects - through successful application of power auger drilling.

Roberts said: “We are very encouraged by these first results, which are providing good indications of widespread gold values in weathered bedrock (saprolite) and some high-grade gold at AG1 - the first of our new targets.”

Follow up AC drilling

The auger drilling continues to identify evidence of widespread gold in saprolite beneath shallow lateritic cover across the Bankan Project, providing numerous targets for follow-up by aircore (AC) drilling.

Roberts added: “We have already identified shallow gold mineralisation from auger drilling closer to NE Bankan and Bankan Creek, which we will follow up with AC drilling in the next month.

“Further AC drilling will be planned on the new northern targets over the next few months after we get a clearer picture from the ongoing auger drilling program.”

Mineral resource estimate

While diamond drilling of depth extensions of the core gold mineralised zone at NE Bankan is ongoing with two rigs, the third drill rig has now moved to Bankan Creek for RC infill drilling on 40-metre spaced lines over a 320 metres strike length.

Results from this drilling will contribute to the maiden resource estimate for the Bankan Project.

In addition, metallurgical test-work is expected to begin this month with core samples being prepared on-site to be air freighted to Australia in the next week.

Long gold corridor emerges

The aeromagnetic survey flown across the Bankan Project has identified nine high priority regional gold drill targets on interpreted ENE -WSW faults, cross-cutting a newly recognised major 35-kilometre-long north-northwest structural corridor.

This structural corridor has the potential to host numerous 'NE Bankan-style' discoveries.

Lithological and structural elements controlling gold mineralization at NE Bankan have provided a new model for gold discovery.

The company said 15,000 metres of regional power auger drilling was now underway, with grids testing nine new targets designed to outline further gold auger footprints.

Bankan sits on 358 square kilometres and to date, auger drilling has been completed over about 20 square kilometres or less than 6% of ground tested.

Looking forward

Roberts said: “Consistent with our focus on advancing Bankan and commitment to our 100%-owned portfolio in Guinea, the company is also progressing its divestment strategy for non-core assets, with opportunities for its Burkina Faso and Cote D’Ivoire licences being progressed to minimise ongoing costs on those projects, whilst maintaining some exposure for shareholders.

“We welcome new investors to the company as part of the placement and, once again, acknowledge the strong support received from many of our existing shareholders.”

Read more on Proactive Investors AU