Ora Banda Mining Ltd (ASX:OBM) has updated estimates for its 100% owned Davyhurst Gold Project mineral resources and ore reserves.

OBM owns an existing centralised 1.2 Mtpa processing hub, as well as additional established infrastructure at Davyhurst. This has facilitated the rapid unlocking of the value contained within the known resource base held by the company.

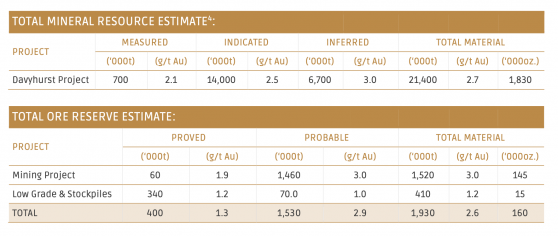

The mineral resource for the eastern goldfields project was calculated using a A$2,400/oz gold price and now sits at 1.8 million ounces at 2.7g/t after mining depletion and the Lady Ida asset sale.

The ore reserves are 160,000 ounces at 2.6g/t, including 145,000 ounces at 3.0g/t excluding low grade and stockpiles.

Reserve grade (excluding stockpiles and low grade) has increased by 50% to 3.0 g/t year-on-year, while cut-off grades for the ore reserve were primarily based on a A$1,850/oz gold price to ensure the focus remains on conversion of higher margin ounces.

“Our strategy to focus on higher-grade underground ore is just beginning, however, we are already seeing the early effect of this change with an increase in Reserve grade by 50% compared to the previous statement,” Ora Banda managing director Luke Creagh said.

“This strategy ensures the quality and value of our current resource and reserve base and directs our focus to higher-margin ounces – both from a production perspective and in the development of future opportunities.

“I am very much looking forward to seeing what our A$9.8 million exploration investment will unlock in FY24, especially noting that we are now drilling underground at Riverina and have exciting advanced underground targets in Missouri and Sand King.”

Missouri, Sand King and Waihi Pits scheduled for progressive completion through 2024

Ora Banda has started underground drilling at Riverina to focus on extensions to the higher-grade mineral resource within the deposit to convert more ounces to reserve.

It has also committed $9.8 million to exploration spend for the 2024 financial year to support its underground strategy and the development of a second underground mine.

The key targets for upcoming exploration will be the Missouri and Sand King prospects.

Deposit locations at Dayhurst.

Mining activities across three significant pits, Missouri, Sand King, and Waihi, are unfolding according to set timelines, targeting completions between the end of 2023 and the March quarter of 2024. The operations involve intricate strategies for resource extraction, risk mitigation and logistical considerations.

Missouri pit's remaining inventories on the 330 metre reduced level (mRL) and 320 mRL benches are expected to be completed by August 2023. Beyond the 310 mRL, the pit will divide into north and south drop-cuts, aimed at optimising the mining cycles. Both drop-cuts are planned to be mined concurrently, with pit completion scheduled for the March quarter of 2024.

Adjacent to Missouri, the Sand King pit will serve as a third working area for the existing Siberia fleet, thereby enhancing operational flexibility. Scheduled for completion by the end of 2023, Sand King will primarily yield high-grade oxide feed, with 80% of the volume to be mined consisting of oxide and transition material. This is anticipated to boost throughput rates and overall efficiency.

Subject to approval by the Ora Banda Board, the Waihi project is slated to start in the June quarter of 2024, with a nine-month operational timeframe. Comprising the Central Pit and North Pit, both filled with tailings from previous mining activities, the project's initial focus will be on the Central Pit. Management of tailings handling and sequencing remains a key operational consideration for Waihi.

Read more on Proactive Investors AU