OD6 Metals Ltd (ASX:OD6) is trading higher on delivering some of Australia’s thickest high-grade clay-hosted REE hits of up to 77 metres over 1,400ppm TREO with several zones in excess of 2,000ppm TREO at its Splinter Rock Project in Western Australia.

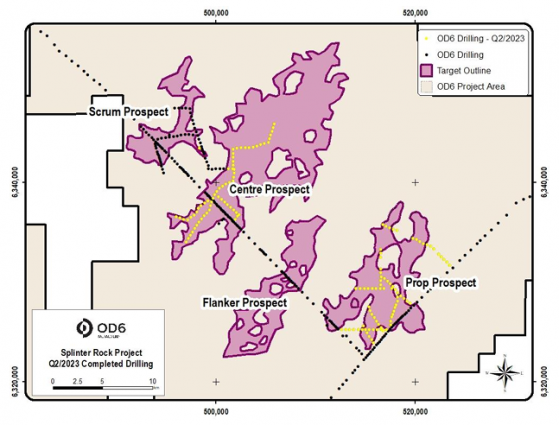

The company’s phase 3 aircore program was designed to test the localised consistency of clay type, thickness and grades at the Centre and Prop prospect areas.

Notably, grades of up to 6,441 ppm TREO were observed in clays with thicknesses of up to 77 metres with a high degree of consistency throughout.

Meanwhile, 77% of holes returned grades greater than 1,000ppm TREO.

Looking ahead, these results warrant a real and substantial potential for mineral resource expansion at the project.

The markets have welcomed the news with shares trading as high as A$0.225, up 25% from the previous close.

Splinter Rock Project completed drilling locations.

“Truly exceptional”

OD6 managing director Brett Hazelden said: “These assay results are truly exceptional, surpassing our previous outstanding results.

“The extent of the Centre Prospect is simply massive, with some of Australia’s thickest high-grade clay hosted REE intercepts at up to 77 metres at over 1,400ppm TREO, with several zones in excess of 2,000ppm TREO.

“The consistency of mineralisation across such a vast 14-kilometre by 5-kilometre zone highlights the quality and significance of our discovery.

“Importantly, a deep, wide clay channel extensional to the southern end of the resource has returned grades in excess of 1,400 ppm TREO.

“The volume and grades in this area alone create the strong potential for substantial resource expansion.

“The geological team of internal and external experts will now start reviewing the current Splinter Rock mineral resource estimate with a view to update this early in the new year.”

Drilling summary

A total of 145 holes across 7,435 metres were drilled at an approximate average depth of 51 metres and a maximum depth of 104 metres at a 400-metre spacing interval.

Assay results covering all 67 holes at the Centre Prospect have been returned with 92% encountering clays with rare earth concentrations greater than 300ppm TREO and 77% of holes intersecting rare earth concentrations greater than 1,000ppm TREO.

The phase 3 drill program received funding through the Western Australian Government’s Exploration Incentive Scheme Co-funded drilling program.

Potential for expansion

The current Splinter Rock maiden inferred mineral resource estimate (MRE) stands at 344 million tonnes at 1,308ppm TREO at a 1,000ppm cut-off grade at 22.8% MREO.

The Centre Prospect represents 149 million tonnes at 1,423ppm TREO at 1,000ppm cut-off grade at 23.1% MREO of the Splinter Rock MRE.

The company’s phase 3 drilling expanded into the broader area with new high-grade drill lines demonstrating a real and substantial potential for resource expansion.

Of particular note is a deep clay channel extensional to the southern end of the resource “Inside Centre” which is approximately 2,000 metres wide, 1,000 metres in length and up to 69 metres thick at grades of in excess of 1,400 ppm TREO.

$OD6 OD6 Metals surges on maiden 344 million tonnes at 1,308ppm TREO resource at Splinter Rock Rare Earth Project https://t.co/m1zFx9ey2G @Od6Metals #OD6 #ASX #ASXNews— Proactive Australia (@proactive_au) July 18, 2023

Read more on Proactive Investors AU