Imagine you're in a dimly lit bar, the kind of place where Wall Street traders loosen their ties and spill secrets. You overhear a conversation between two men, both seasoned investors.

One of them, let's call him Jack, is a traditionalist. He's all about blue-chip stocks and bonds. The other, we'll name him Oliver, is a modern-day gold prospector, albeit in a suit and tie. Oliver is trying to convince Jack that the real treasure lies in gold mining stocks.

"Listen, Jack, you're missing out on the gold rush of the 21st century," Oliver says, sipping his Old Fashioned.

Jack rolls his eyes. "Gold? Really? That's so last millennium."

Oliver leans in, "Ah, but that's where you're wrong. The dynamics have changed. Demand is outpacing supply, leaving an annual shortfall of 500 metric tons. The economic equation of physical gold is rapidly changing, my friend."

The New Gold Rush: Understanding the Dynamics

Oliver's point is valid. The worldwide gold industry is worth an estimated $14.7 trillion, supported by the extraction of about 208,874 tonnes of the precious metal throughout human history. But here's the kicker: demand is outpacing supply, leaving an annual shortfall of 500 metric tons. This shortfall is putting upward pressure on gold prices, making it one of the top reasons to invest in gold.

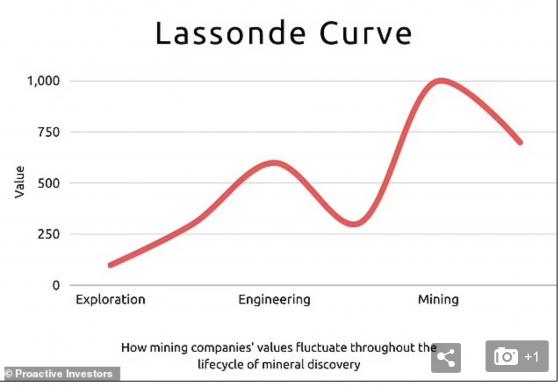

The Lassonde Curve: A Miner's Crystal Ball

Oliver pulls out his phone and shows Jack a graph known as the Lassonde Curve. Created by Pierre Lassonde, a founder of Franco-Nevada, the first gold royalty company, this model outlines the life of a mining company from exploration to production. It helps investors gauge market value through each stage of the process.

"See this curve? It's like a miner's crystal ball. It tells you where a mining company is in its life cycle and how to value it," Oliver explains.

Valuing Gold Mining Stocks: The P/NAV Method

"Alright, you've got my attention. But how do you value these stocks?" Jack asks.

"Price to Net Asset Value (P/NAV)," Oliver replies. "It's the most important mining valuation metric. Net Asset Value (NAV) measures the value of a company’s assets minus its liabilities. The P/NAV ratio gives you a snapshot of whether a mining stock is undervalued or overvalued."

Case Study: The Tale of Two Miners

To illustrate, Oliver concocts a fictional scenario involving two mining companies: GoldenProspect Inc. and RiskyVenture Ltd.

GoldenProspect has a P/NAV ratio of 0.5, indicating it's undervalued. They have a proven track record, stable cash flows, and their mines are located in politically stable regions.

On the other hand, RiskyVenture has a P/NAV ratio of 2.5. They're a junior mining company with unproven reserves and their operations are in politically unstable areas.

"Who would you bet on?" Oliver asks.

Jack thinks for a moment. "GoldenProspect seems like the safer bet."

"Exactly. But here's where it gets interesting. RiskyVenture, despite its high P/NAV and risks, has a potential for extraordinary gains if they strike gold. It's high risk, high reward."

The Majors and The Juniors: A Risky Love Affair

Oliver goes on to explain the symbiotic yet risky relationship between major and junior mining companies. Majors are well-capitalized companies with decades of history and slow, steady cash flow. Juniors are the opposite; they're smaller, newer, and riskier.

"Majors love to let juniors take all the risks of finding new deposits. Once the juniors strike gold, the majors swoop in and buy the reserves," Oliver says.

The M&A Game: Where Juniors Become Majors

Oliver tells Jack about the increasing trend in mergers and acquisitions (M&A) in the gold mining industry. "Majors have cash reserves at an all-time high, and they're looking to acquire. Juniors with proven reserves become prime targets. It's like a corporate version of 'The Bachelor,' but instead of a rose, you get a multi-billion-dollar deal."

The Final Nugget: Due Diligence is Key

"As with any investment, due diligence is key," Oliver concludes. "Look at the company's balance sheet, assess geopolitical risks, and always, always understand the valuation metrics."

Jack is sold. "Alright, Oliver, you've convinced me. I'm ready to join the new gold rush."

As they leave the bar, Oliver can't help but think that he's just turned data into gold, at least in Jack's portfolio. And that, in essence, is the alchemy of gold mining stocks.

Understanding the Lassonde Curve

By our mining editor, Alastair Ford

'The shares are due for a re-rating.'

It's an easy phrase to bandy around, but what does it actually mean?

Is there any way of quantifying how or why a re-rating of a given company might be due?

Well, in the mining sector, there is.

It's known as the Lassonde Curve and it has a long pedigree of use by analysts trying to make sense of where share prices might go in the absence of revenues and given the propensity for explorers and developers frequently to issue new equity.

In essence, the curve presents the different stages of exploration and development and shows how share prices are likely to rise or fall depending on exactly where any given company sits on the curve.

Model: The Lassonde Curve shows how share prices are likely to rise or fall depending on exactly where any given mining company sits on the curve

It's named after Pierre Lassonde, the founder of one of Canada's biggest royalty companies, Franco-Nevada.

And if ever there was a man who knows about investing for growth, it's Pierre Lassonde.

Franco Nevada was founded in the 1980s off a fundraising that amounted to less than C$1 million. Today, the company is worth nearly C$37 billion, and Lassonde remains chairman emeritus.

So how does the curve work?

Well, resources company shares are worth mere pennies – or even fractions of pennies – at the speculative exploration phase, when all they really have is an idea. But following initial drill results, if successful, the shares will likely strengthen, and if a full-blown discovery is made will likely strengthen further on each successive set of results.

Gradually a resource is built up, value is confirmed and the shares strengthen further.

This is the first upward lift of the Lassonde Curve, driven by speculative money moving into the stock in response to ongoing exploration success. It's also often the most pronounced upward arc of the curve.

Next comes a period of consolidation

You've got a resource – well and good, but now you need to do all the necessary but less value-enhancing work like metallurgy, environmental studies, economic evaluations, permitting, and so forth.

There's no getting around this process, but creating abstract valuation models and doing necessary technical work just doesn't have the same energy as the discovery of, say, a million ounces of gold.

At this point, the shares are likely to drift, as shareholders find it hard to identify imminent inflection points. The first downward arc of the Lassonde Curve has begun.

Often, companies try to counteract this well-established pattern by running drill programmes on other projects to keep newsflow coming. And this can sometimes work. But it doesn't invalidate the Lassonde Curve model – it merely runs interference on one curve by setting up a second curve for another project.

One-project companies don't have this luxury, although being focused on one project is often a more straightforward proposition for equity investors to get their heads around.

Because in the end, if the project is good enough, a share price revival will come.

Why is this?

Simple. At some point, the market will begin to wake up to the reality that a project is going into production.

By then, most of the hot speculative money that drove the valuation at earlier points on the curve is already likely to be out, and new, more serious and institutional money will start coming in, looking for growth in NAV and for yield. And another re-rating occurs.

Within this model, there are nuances

For example, it's often held that the best time to trade on the upward leg of the earlier curve is before drill results come in.

That's because speculative money will come into the shares on anticipation of success and drive the price up. But there remains the very real possibility of failure. In such event, the shares will likely drop back to their starting level and nobody will be any the better off.

However, anyone selling before the results were known would have been able to lock in speculative gains.

Occasionally, the speculative run-up before exploration results are released can mean that success, when it comes, has already been priced in, and by the time the good news is known the share price has run out of momentum.

Read more on Proactive Investors AU