Maximus Resources Ltd (ASX:MXR, OTC:MXRRF) has now received all assays from its recently completed reverse circulation (RC) drill program at the Kandui Nickel Prospect and Hilditch Gold Project, both part of the greater Lefroy Lithium Project in Western Australia.

The completed drill program was designed to test multiple targets at Kandui and Hilditch and consisted of 15 RC drill holes for a total of 1,658 metres.

Lithium intersections

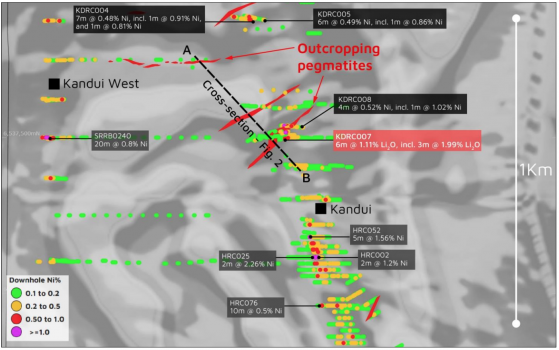

Drilling at Kandui, comprising eight RC holes for 788 metres, intersected several zones of shallow dipping lithium-bearing pegmatites including 6 metres at 1.11% lithium oxide (Li2O) from 90 metres, including 3 metres at 1.99% Li2O.

Maximus managing director Tim Wither said: “This drilling program has revealed a new lithium-bearing pegmatite at Lefroy that was hidden under cover.

“The previously unknown lithium-bearing pegmatite is a very exciting development, as we are about to launch the first phase of our drilling program across the Lefroy lithium prospect in collaboration with our KOMIR partners.

“Kandui is known to have several shallow dipping intrusive pegmatites, crosscutting the nickel mineralisation, and this discovery highlights the potential for more lithium-bearing pegmatites to be found across the large lithium anomaly to be drill-tested at Lefroy.”

Numerous shallow dipping pegmatites have been identified within the Lefroy area, coinciding with an extensive 2-kilometre by 1-kilometre lithium soil anomaly. Rock chips have confirmed fertile lithium-cesium-tantalum (LCT) pegmatites with strong potassium/rubidium (K/Rb) ratio fractionation.

This intersected lithium-bearing pegmatite highlights the opportunity for additional blind pegmatites to be defined under shallow cover through soil geochemistry and in the upcoming drilling.

Maximus’ upcoming 3,000 metre RC drill program, funded by Korean government agency, KOMIR, will test a large lithium anomaly with known pegmatites across the Lefroy project.

Nickel, gold mineralisation

Shallow broad zones of nickel sulphide mineralisation at the basal contact were also intersected at Kandui.

The extensive zones of shallow nickel sulphide mineralisation beneath the defined nickel- copper-platinum group elements soil geochemical anomaly validates Maximus’ multi-element soil geochemistry exploration strategy.

Assay results include:

- 7 metres at 0.48% nickel from 6 metres including 1 metre at 0.91% nickel from 11 metres, and 2 metres at 0.62% nickel from 18 metres including 1 metre at 0.81% nickel from 19 metres; and

- 4 metres at 0.52% nickel from 100 metres including 1 metre at 1.02% nickel from 125 metres

The multi-target drill program also included the Hilditch Gold Project, for seven holes for 870 metres, with the aim of updating the mineral resource estimate.

Maximus notes that all drill holes at Hilditch have intersected gold mineralisation and a mineral resource update is underway.

Wither added: “In addition to the confirmed lithium potential, the nickel results at Kandui are very encouraging and provide strong validation of the effectiveness of the company’s geochemistry soil mapping program. All holes intersected nickel mineralisation proximal to an interpreted basal contact, and follow-up drilling is warranted.

“Lastly, the separate drilling at Hilditch Gold continues to be effective, with these and previous drill programme results to be utilised for a gold resource update. Due to its shallow high-grade mineralisation, Hilditch has the prospect to be a near-term production source for the company.”

Kandui Prospect location plan showing completed drilling, downhole nickel grades, and outcropping pegmatites.

Korean government farm-in

As previously announced, Maximus has entered a US$3 million ($4.8 million) farm-in agreement with the Korea Mine Rehabilitation and Mineral Resources Corporation (KOMIR) in regards to Lefroy.

KOMIR is a Korean government agency responsible for national resource security, including developing overseas mining and processing capacity to supply the Korean market.

A separate non-binding MOU executed provides global battery manufacturer LG Energy Solution with a non-binding option to acquire KOMIR's 30% interest in the Lithium JV.

Looking ahead

Lithium

Maximus has commenced a tenement-wide lithium exploration soil sampling program to identify potential lithium-bearing pegmatites, hidden under shallow cover, which should be completed within two months.

Then, in early November, an initial 30-hole, 3,000-metre RC drilling program centred around a lithium soil anomaly is set to commence.

Nickel

Maximus has cased several holes at Kandui in preparation for a down-hole electromagnetic (DHEM) survey, aiming to highlight potential off-hole conductor locations to assist in future drill hole targeting.

The company continues to develop further nickel drill targets through targeted platinum group element soil sampling within the Kandui, Sorake, Pinnacles, and Le-Bar Prospects.

Gold

Upon receiving the final assay results from Hilditch, the company began to update the mineral resource estimate. Following an internal assessment, it also began a review of the Larkinville Gold Project mineral resource, hoping to bolster the company’s 320,500 ounce gold resource.

The resource updates are due to be finalised by early December.

Read more on Proactive Investors AU