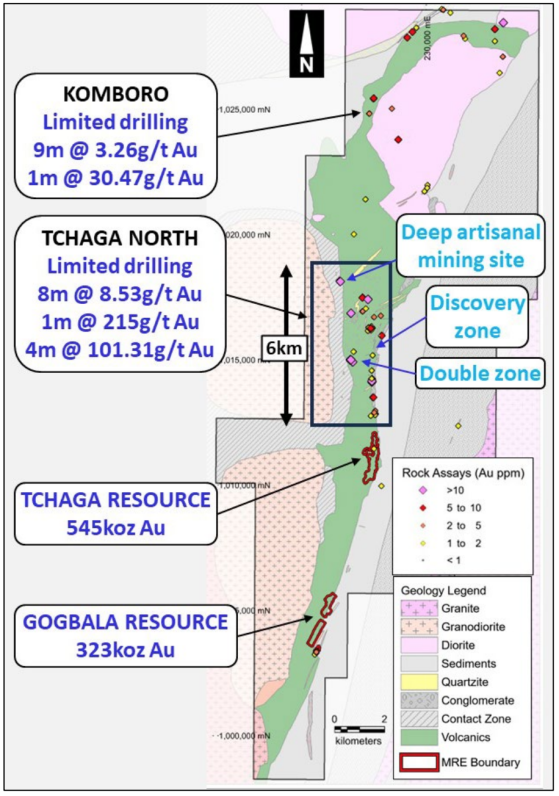

Mako Gold Ltd (ASX:MKG) has received shallow, high-grade gold results from a 1,200-metre scout drilling program at Tchaga North prospect on the company’s flagship Napié Project in Côte d’Ivoire, confirming the prospect as a high-grade target for further drilling.

Scout drilling, which was carried out to target high-grade gold zones identified during recent mapping and trenching programs, focused on the Deep Artisanal Mining Site, the Discovery Zone and the Double Zone to test new east-west targets which had never been drilled.

Mako managing director Peter Ledwidge said: “The results returned from the 1,200-metre scout drilling program confirms Tchaga North as one of the zones to focus on for adding potential ounces to our current 868,000-ounce maiden resource.

“There is little to no outcrop at Napié, therefore the confirmation of high-grade gold in drill holes at various prospects within Tchaga North provides a good starting point for further drilling at depth, and along strike.

“Of particular interest is the Deep Artisanal Mining Site where the southeasterly direction of the workings returned strong drill results which align with previous high-grade rock chip samples with values up to 76 g/t gold. This has delineated a 1.2-kilometre mineralised corridor which warrants further drill testing.”

Napié Project – Tchaga North with new high-grade zones recently identified by mapping.

Deep Artisanal Mining Site

At Deep Artisanal Mining Site, drilling returned 7 metres at 5.39 g/t gold, including 1 metre at 31.15 g/t, below the workings of the artisanal mining site — confirming this site as a target for further drilling.

Once the site of considerable artisanal mining, only a handful of miners remain on site as the water table and hard rock limits their digging to a maximum of 40 metres.

Previous rock chip sampling at the spoil piles returned values including 24.34 g/t, 9.47 g/t and 4.55 g/t gold.

Mako notes that the southeast orientation of the artisanal mining pit aligns perfectly with the previously announced high-grade rock chip samples to the southeast, which confirms a 1.2-kilometre mineralised corridor as an “excellent” target for further drilling.

A 1.2-kilometre-long mineralised corridor is a target for further drilling.

Discovery Zone

Discovery Zone drilling returned 6 metres at 1.74 g/t gold from 11 metres, including 1 metre at 8.70 g/t from 15 metres; and 2 metres at 1.83 g/t from 65 metres within a broad mineralised envelope of 33 metres at 0.33 g/t. Previous drilling in multiple drilling directions returned 8 metres at 8.53 g/t and 1 metre at 215 g/t.

This drilling intersected gold in structures with varying orientations, suggesting multiple events of gold mineralisation, with further diamond drilling warranted to ascertain the trend of the highest-grade mineralisation.

Recently announced trenching in this zone returned gold intersections of 4 metres at 3.97 g/t gold, including 1 metre at 14.80 g/t, and 4 metres at 1.79 g/t, including 1 metre at 5.34 g/t.

Discovery Zone – select new (yellow) and previous (white) drill intercepts. Note that gold is intersected in multiple drilling directions suggesting multiple events of gold mineralisation.

Read more on Proactive Investors AU