Magnetite Mines Ltd (ASX:MGT) has surged on completing a robust optimisation study on the Razorback Iron Ore Project in South Australia that highlights the Iron Peak high-grade deposit’s potential to service the green steel market.

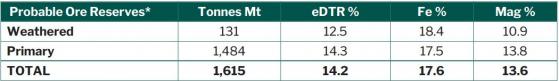

Providing further confidence for MGT is a vastly increased project scale with the company boosting the ore reserve by 340% or 1.1 billion tonnes of iron ore to 1.6 billion tonnes.

The optimisation work is particularly relevant as Iron Peak was not included in this latest ore reserve, offering potential for a high-value market opportunity and further material growth for the project’s resource.

Welcoming the positive news, investors have responded strongly, sending shares almost 32% higher in early trading to $0.725.

Green steel market opportunity

“These outstanding optimisation study results highlight the exceptional value of our 100%-owned Razorback Iron Ore Project and validate Magnetite Mines' decision to incorporate market feedback into a larger, higher-value Stage 1 development scenario,” Magnetite Mines CEO Tim Dobson said.

“The project has been optimised on all fronts, headlined by a substantial, but manageable, Stage 1 production scenario capable of producing of 5 million tonnes per year, with potential staged expansion up to 10 million tonnes a year.

“We are now prioritising the assessment of Iron Peak for ore reserves, enabling the completion of financial modelling for the new project configuration, and taking advantage of Iron Peak’s superior mass recovery and metallurgy.

“Magnetite Mines is creating an extraordinary opportunity to capitalise on the fast-growing momentum towards 'Green Steel', with the focus of regional steelmakers now increasingly on supply from tier 1 jurisdictions with renewable energy grids and emerging green hydrogen production such as South Australia.

“We are well positioned to now enter a final study phase and deliver a definitive feasibility study (DFS) based on a superior project design, which will generate significant, sustainable value for all shareholders.”

MGT plans to begin operations at Razorback with the highest grade ore available at Iron Peak, a well-proven strategy for de-risking economic performance during the first few critical years of a new mine.

Read: Magnetite Mines lifts mass recovery to 19.4% in Iron Peak resource update; project economics enhanced

Ore reserve supports 45 years of production

“Magnetite Mine’s decision to increase the production scale of Razorback to a minimum 5 million tonnes per annum along with our recently updated mineral resource estimate has catalysed this update of the Razorback Project ore reserves,” Magnetite Mines CEO Tim Dobson said.

“The updated ore reserves are classified as probable and have been calculated using only the most accurate and highest-confidence project data available.

“With a mass recovery of 14.2%, these ore reserves would sustain operations at 5 million tonnes per year production for around 45 years.

“The team is now completing mining studies on the recently upgraded, high-grade Iron Peak deposit and we can expect a further uplift in project ore reserves to be announced in the near future.”

Razorback Iron Project ore reserves estimate at March 2023.

Read more on Proactive Investors AU