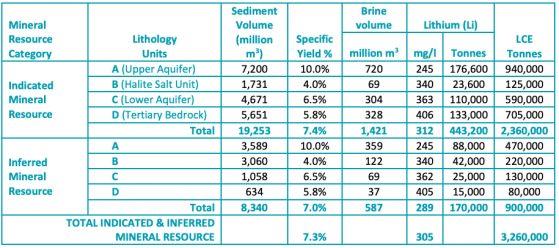

Lithium Energy Ltd (ASX:LEL) has further solidified the position of its flagship Solaroz Lithium Brine Project in Argentina as a highly strategic lithium asset by delivering an upgraded 2.4 million tonnes of indicated lithium carbonate equivalent (LCE) resource based on drilling and extensive geophysics completed so far.

This significant milestone achievement follows the company’s publication of a 3.3-million-tonne total indicated and inferred mineral resource estimate (MRE) just four months earlier.

The indicated MRE encompasses Chico I, Chico V, Chico VI, Payo 2 South and Silvia Irene, otherwise known as the Central Block concessions, of the project.

Significantly, there is a high-grade core of 1.3 million tonnes of LCE with an average concentration of 400 mg/l lithium at a 320 mg/l cut-off grade within the total MRE.

The upgraded total indicated and inferred MRE.

Potential for further conversions

The Solaroz Project, 90%-owned by LEL, comprises eight mineral concessions totalling 12,000 hectares on the Salar de Olaroz basin in the heart of South America’s world-renowned Lithium Triangle.

The concessions are located in three groups:

- Northern Block: Payo 1 and Payo 2 North concessions totalling about 2,731 hectares;

- Central Block: Chico I, V and VI, Payo 2 South and Silvia Irene concessions totalling about 8,631 hectares; and

- Southern concessions: Mario Angel (542.92 hectares) and Payo (987.62 hectares).

LEL is one of only three groups that control the lithium concession rights on the 45,000-hectare Olaroz Salar, along with Allkem Ltd (ASX:AKE, OTC:OROCF, TSX:AKE) and Toronto-listed Lithium Argentina Corporation.

The ASX-lister completed eight diamond drill holes and one rotary hole for a total of 5,087 metres for the upgraded indicated MRE.

The company is in the midst of seeking environmental approvals for the next phases of the drilling program at Solaroz comprising:

- Additional (including in-fill) holes in the Central Block (Chico I, V and VI, Payo 2 South and Silvia Irene concessions), to further upgrade the resource confidence;

- Drilling to further evaluate the Payo 1 and Payo 2 northern concessions;

- Drilling of large diameter production test wells for evaluation of both brine and industrial water flow rates and determination of aquifer characteristics; and

- Drilling and installation of monitoring wells to collect baseline data to support the preparation of an environmental impact assessment for Solaroz.

“Very significant milestone”

“Having the majority of the inferred resource converted to the higher confidence indicated category is a very significant milestone for the company, as these indicated resources will now underpin the Hatch Scoping Study for Solaroz, the results of which will be released shortly,” LEL executive chairman William Johnson said.

“Solaroz is located on the Olaroz Salar in northwest Argentina, one of the best locations in South America’s Lithium Triangle for developing large scale lithium brine operations, as evidenced by our Olaroz neighbours Allkem and Lithium Argentina.

“Allkem has reported production of lithium carbonate from Olaroz since 2015 using traditional brine evaporation, with latest reported cash costs of only US$4,149 per tonne LCE and high margins per tonne of LCE."

Read more on Proactive Investors AU