Latin Resources Ltd (ASX:LRS, OTC:LRSRF) has completed a placement to raise $35 million, with funds to expand and accelerate its exploration program at the Salinas Lithium Project in Brazil.

The company already has drill rigs mobilised as it looks to 2024. The expanded drill program heading into the new year will run parallel to geotech and hydrogeology works to support the definitive feasibility study (DFS) expected to be announced in H1 2024.

Through the drilling program, Latin also expects to significantly expand the global JORC mineral resource estimate (MRE). Currently, the company’s defined total MRE at its Colina Lithium Deposit is 45.2 million tonnes at 1.32% Li2O, reported above a cut-off of 0.5% Li2O.

The classification of this JORC MRE includes 30.2 million tonnes at 1.4% Li2O of the total resource now sitting in the measured + indicated category (430,000 tonnes at 1.34% Li2O measured + 29.7 million tonnes at 1.37% Li2O indicated) plus 15 million tonnes at 1.22% Li2O in the inferred category.

Along with assisting in increasing the MRE, funds will be used for the following:

- an expanded exploration drilling program through 2024;

- completing additional geotech and hydrogeology works to support the DFS;

- providing additional funding to facilitate the company’s expanded land acquisition budget; and

- supporting the company’s working capital requirements.

“The new funds will enable the company to continue to grow its Salinas resource to become a tier-1 lithium global project,” Latin’s managing director Chris Gale said.

“I would like to thank all new and existing shareholders for their ongoing support and look forward to accelerating the development of Latin’s Salinas Project as we continue to meet our objectives.”

About the raise

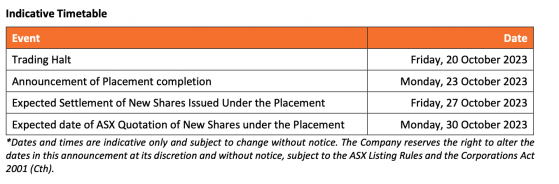

Latin will issue approximately 140 million new shares at an issue price of A$0.25 to raise approximately $35 million.

New shares will be issued in a single tranche. The offer price represents a:

- 5.7% discount to the last closing price of A$0.265 on October 19, 2023;

- 11.7% discount to the 5-day VWAP of A$0.283; and

- 11.1% discount to the 10-day VWAP of A$0.281.

Results continue to flow

Just last week, Latin noted that its drill results had moved Salinas closer to becoming a tier-1 lithium deposit.

Through step-out drilling immediately to the southwest of Colina, Latin discovered a new pegmatite cluster, adding significant strike extensions to the already considerable mineral resource footprint at Colina.

There was further good news this month from research and capital markets provider Pac Parners which recommended Latin as a Buy with a 50-cent price target on the stock — almost double Latin’s current 26-cent share price.

Read more on Proactive Investors AU