Helix Resources Ltd (ASX:HLX) has executed an option agreement with Alchemy Resources Ltd (ASX:ALY) to consolidate its nickel-cobalt assets in New South Wales under 100%-owned subsidiary Ionick Metals Ltd ahead of the latter’s planned spinout.

The agreement entails Helix acquiring 80% of Alchemy’s interest in the West Lynn Nickel Laterite Project, an advanced project south of Nyngan in central NSW with an inferred mineral resource estimate (MRE) of 180,000 tonnes of nickel and 11,000 tonnes of cobalt.

This acquisition has almost doubled Ionick’s resource inventory to around 40 million tonnes and is key to securing external funding for its laterite nickel and cobalt business.

The West Lynn rights cover exploration licences EL8318 and EL8631 comprising nickel, cobalt, platinum group metals (PGMs), scandium and aluminium, which are held under the Ochre Resources joint venture between Alchemy and Develop Global Ltd, which holds the remaining 20%.

Investors have reacted positively to the news, with Helix shares 33.3% higher at $0.0040 in mid-morning trading.

Commercialisation move

“This option with Alchemy completes significant local ‘consolidation’ of nickel-cobalt assets in the region and underpins a planned spinout of Ionick Metals from Helix,” Helix chair Mike Rosenstreich said.

“We appreciate the support of Alchemy to combine these nickel-cobalt assets into what we plan to be a stand-alone vehicle, Ionick Metals, to commercialise them.

“A key objective for Ionick will be to define a large-scale high-grade mineral resource estimate greater than roughly 80 million tonnes.

“We think this is a threshold for a ‘meaningful’ scale nickel project in terms of production output and mine life to initiate the appropriate feasibility work.

The Ionick strategy

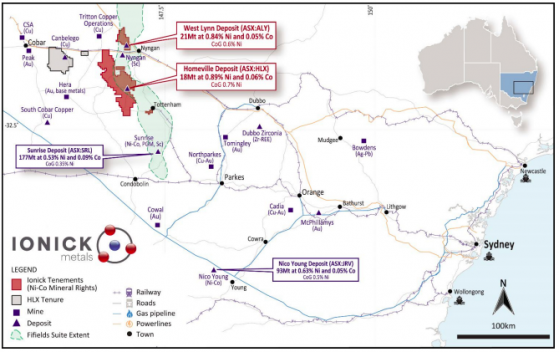

Helix’s broader strategy is to split its copper-gold and nickel-cobalt mineral rights, the latter under Ionick, whose core assets include Homeville and now, West Lynn and 1,797 square kilometres of prospective nickel-cobalt-PGM tenure.

The company believes a spinout of Ionick is a compelling opportunity to unlock the hidden value of its assets and an initial public offering (IPO) is the ideal pathway to fund its development.

Moreover, a different skillset and risk appetite apply to commercialise Helix’s copper-gold assets versus its nickel-cobalt assets.

Location of Ionick nickel-cobalt mineral rights in NSW.

The company aims to raise $10 million from the IPO targeted for early in the June quarter of next year, with a priority offer to shareholders of Helix, Alchemy Resources and Jodama Pty Ltd, the latter a privately-held company with whom Helix has an option agreement with for the Hillview, Woodlong and Murrabee nickel-cobalt-PGM prospects.

The offer will comprise:

- 6 million shares to Alchemy for 80% of its nickel-cobalt mineral rights;

- 7.5 million shares to Helix for 100% of its nickel-cobalt mineral rights; and

- 1.5 million shares to Jodama for all the mineral rights on its tenements.

Different strategy needed

“Ionick’s development strategy, which emphasises consolidation and development of high nickel-grade and large-scale tonnage, highlights how alert we are to the challenges faced by other laterite projects, which have become stranded in terms of interest and financing,” said Rosenstreich, who is also a director of Ionick.

“We are building on what we consider are key points of difference to be able to progress Ionick into development.

“Laterite projects offer some unique opportunities to get involved in long-term and large-scale nickel production compared to sulphide nickel projects and it is very exciting to see the Ionick business plan take shape.

“Having completed this vital asset consolidation, we can now start to have serious conversations aimed at recruiting a high-quality board and executive team with technical and commercial nickel experience to build upon and execute our strategy,” he added.

Read more on Proactive Investors AU