Flynn Gold Ltd (ASX:FG1) is moving to add two drill-ready gold and battery metals projects to its portfolio in Tasmania through an option agreement with Greatland Pty Ltd, a wholly-owned subsidiary of Greatland Gold PLC (AIM:GGP, OTC:GRLGF).

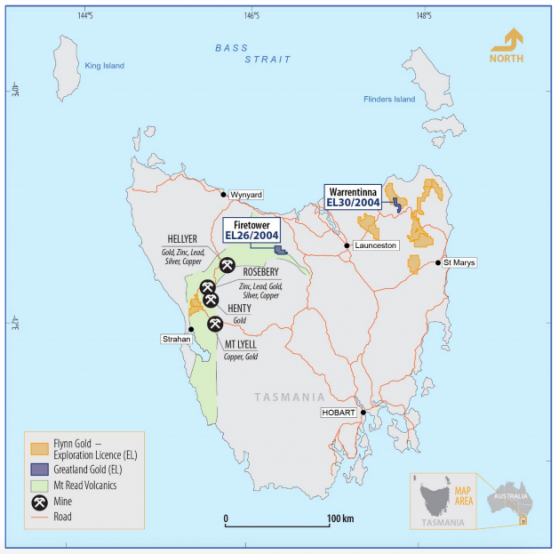

The Firetower Gold and Battery Metals Project and the Warrentinna Gold Project in northern Tasmania cover 99 square kilometres of highly prospective ground and have been previously drilled by Greatland.

Firetower is hosted in the Mount Read Volcanic belt, one of Australia’s premier volcanic-hosted massive sulphide (VHMS) provinces, which includes the world-class Mt Lyell, Rosebery, Hellyer and Henty deposits

Warrentinna covers an area of about 37 square kilometres immediately adjacent to Flynn’s existing tenure at Lyndhurst. The tenement encompasses two historic goldfields, Forester and Warrentinna, with limited modern exploration.

"Complement our projects"

“We are delighted to announce the option to acquire these two advanced projects in Tasmania, which complement our existing gold and battery metals projects in the state,” Flynn chief executive officer Neil Marston said.

“Flynn will now undertake a program of data review, geological modelling, site reconnaissance and exploration planning during the six months option period.

"We look forward to completing this process with a view to exercising the option ahead of drilling in 2023.”

Location of Flynn’s Tasmanian Projects, including the Firetower and Warrentinna projects.

Option details

Flynn paid a non-refundable option fee of $100,000 through the issue of 1 million Flynn shares at $0.10 each to Greatland when the parties entered into the option agreement on November 30, 2022.

The company has six months or 10 business days after the receipt of drilling permits from Mineral Resources Tasmania (MRT), whichever is later but no later than June 30, 2023, to exercise the option.

If it decides to do so, it needs to pay $200,000 or issue 2 million shares, which may be subject to shareholder approval at a later date, to Greatland.

Subsequently, the company will pay Greatland $500,000 when a combined JORC-compliant gold mineral resource of 500,000 ounces is published on the projects, and a further $500,000 when a mine permit is issued by MRT for any one of the projects.

Flynn has also agreed to grant Greatland a 1% net smelter royalty on all production from the projects.

Enormous potential

Previous drilling at Firetower delineated gold mineralisation over 350 metres along strike and up to a depth of 150 metres, which remains open at depth and along strike.

Drilling in 2019 yielded 54.5 metres at 1.36 g/t from surface, including 5.0 metres at 5.41 g/t from 45 metres; and 5.0 metres at 8.72 g/t from 81 metres, including 2.0 metres at 21.20 g/t from 81 metres.

The gold system appears to host anomalous cobalt up to 0.57% and tungsten up to 0.73% but has not been evaluated further by previous explorers.

Drilling at the Warrentinna Project indicates the potential for a significant orogenic-style gold system, with shallow targets to drill test.

Results from 2019 included 21.7 metres at 3.3 g/t from 9.3 metres, including 2.2 metres at 12.0 g/t from 10.8 metres; and 11.7 metres at 2.8 g/t from 115 metres. Its limited exploration has presented shallow gold targets to drill test.

Firetower Project geology and gold prospects.

Warrentinna Project geology and gold prospects.

Data on hand

Flynn has received all technical information on the projects from Greatland and will now undertake a thorough review of the data, perform geological modelling, potentially assay/re-assay selected drill core/samples, and conduct field reconnaissance to plan the next phase of exploration over the coming months.

If the option is exercised, the company expects to commence drilling at both projects shortly after.

Flynn has eight 100% owned granted tenements in northeast Tasmania and is establishing a portfolio of lithium-gold exploration assets in the Pilbara and Yilgarn regions of Western Australia.

It also has prospective tin projects within its northeast Tasmania gold project, as well as two zinc-silver tenements on Tasmania’s mineral-rich west coast.

Read more on Proactive Investors AU