By Arathy S Nair, David French and Shariq Khan

(Reuters) - Top U.S. shale oil producer Pioneer Natural Resources (NYSE:PXD) Co has put its assets in the Delaware basin of Texas on the block, aiming to secure more than $2 billion for the properties, two sources familiar with the matter told Reuters on Friday. A strong rebound in crude oil prices following last year's pandemic-led crash has sparked a wave of shale consolidation and opened a window for producers to offload unwanted properties. Pioneer wants to streamline its business and reduce debt after two big acquisitions this year. In March, it sold an oilfield services business for an undisclosed amount.

There was no guarantee Pioneer would end up striking a deal. The company did not immediately reply to a request for comment.

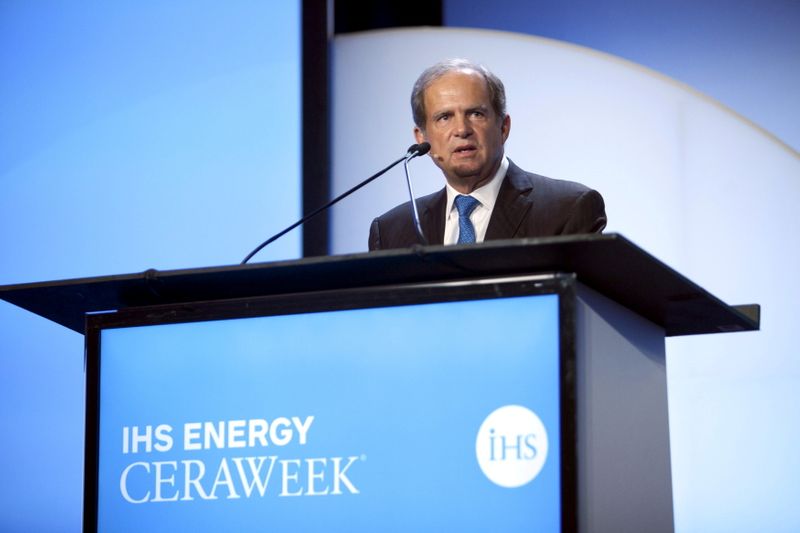

A sale would leave Pioneer focused on the Midland portion of the Permian, its traditional base. The assets now for sale were acquired with its $4.5 billion purchase of Parsley Energy, the sources said. Parsley has about 350 wells across four counties in the Delaware Basin. Pioneer Chief Executive Scott Sheffield last week told investors the company likely would divest some of its less-productive acreage in the Delaware and Midland basins in Texas. Pioneer this year completed two multi-billion dollar takeovers. After closing its Parsley deal in January, Pioneer paid $6.2 billion deal for Midland-basin rival DoublePoint Energy. The deals pushed Pioneer's total debt to $6.9 billion at the end of June, from $3.1 billion six months earlier, according to regulatory filings. As part of the wider industry focus to improve investor sentiment after years of sub-standard returns versus other economic sectors, U.S. shale firms have been boosting buybacks and dividends. Last month, Pioneer said it was bringing forward plans to start paying a variable quarterly dividend to September, from the first quarter of 2022.