(Bloomberg) -- Chinese tech stocks fell, tracking overnight weakness in their U.S. peers, as hawkish comments from the Federal Reserve dampened sentiment toward richly-valued growth shares.

The Hang Seng Tech Index slid as much as 4.1% in early Wednesday trading after a one-day holiday in Hong Kong, with Alibaba (NYSE:BABA) Group Holding Ltd. and JD (NASDAQ:JD).com Inc. among the biggest decliners. The broader Hang Seng Index dropped as much as 2.1%.

The slide suggests sentiment remains weak in the sector even after Chinese regulators over the weekend sought to defuse U.S. delisting risks with a radical rule change proposal. The Nasdaq Golden Dragon Index fell 4.6% overnight, after a two-day 12% rally, while the tech-heavy Nasdaq 100 index dropped 2.2%.

“Risks remain for the broader Chinese economy as Covid lockdowns prompt analysts to cut GDP and earnings forecasts, with the results season unable to ease worries,” wrote Marvin Chen, a Bloomberg Intelligence analyst.

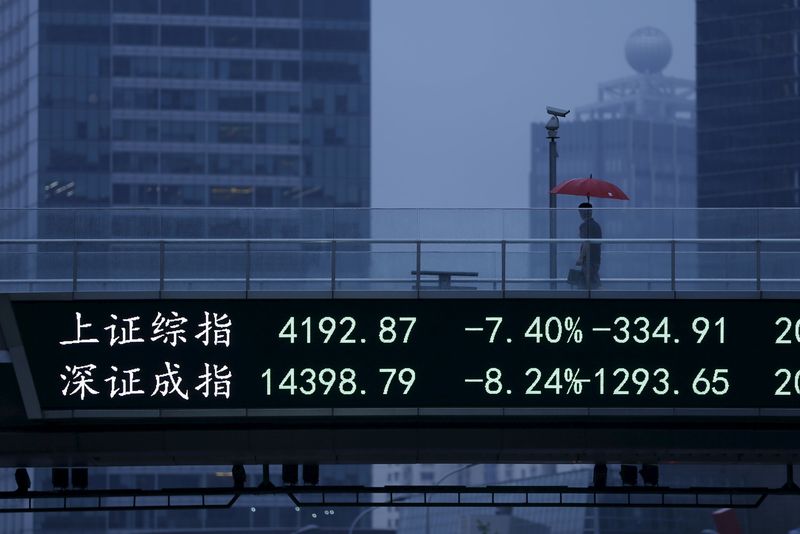

In China, where stock markets opened for the first time this week, the CSI 300 Index fell by as much as 0.9%. Among worries included Shanghai’s growing Covid outbreak, the nation’s worst to date, with harsh restriction measures hurting the outlook for growth.

Economists have been rushing to cut China’s growth forecasts as lockdowns and various curbs cover vast swathes of the nation. A Wednesday report by Caixin Media and IHS Markit showed China’s composite purchasing managers’ index for March slumped to 43.9, the lowest in more than two years and falling deeper into contraction.

Asian stock markets also broadly fell, triggered by comments from Federal Reserve Governor Lael Brainard, who said the central bank will raise interest rates steadily while starting balance sheet reduction as soon as next month.

©2022 Bloomberg L.P.