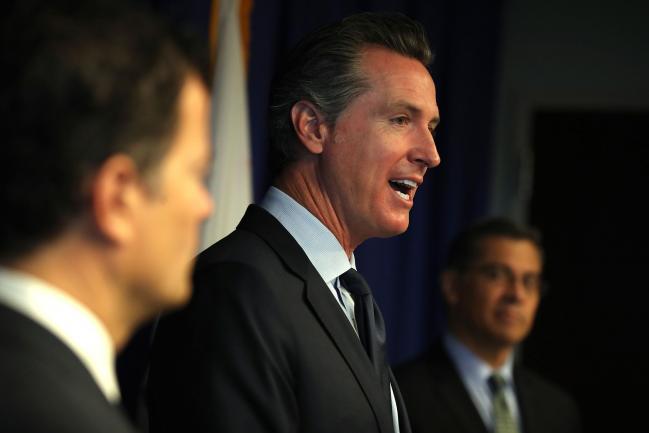

(Bloomberg) -- California Governor Gavin Newsom has long called for PG&E Corp. to emerge from its bankruptcy radically transformed. Now, the beleaguered utility has to race to meet his demands -- or else see its restructuring plan blow up.

The state’s largest power company has until Tuesday to address conditions that Newsom laid out in a letter late last week rejecting its reorganization proposal. The governor said the current plan falls “woefully short” of meeting requirements of a key state law and insisted on changes that could reshape PG&E, including an entirely new board and the option for a takeover.

Newsom’s rebuke upends PG&E’s restructuring just as the path toward a smooth exit next year seemed to be clearing. The San Francisco-based company, in bankruptcy after its equipment caused massive wildfires, earlier this month reached a $13.5 billion settlement with victims of the blazes. The deal, however, is dependent on the governor’s support and his determination that the reorganization complies with a state law that would provide financial assistance for future fire costs.

“His list of demands might be hard for the company to accept, putting the whole Chapter 11 timeline in jeopardy,” said Jared Ellias, a bankruptcy law professor at the University of California, Hastings. “He could have asked for something akin to changing the drapes. Instead it’s more like he is asking them to change their floor plan.”

In his letter to PG&E Chief Executive Officer Bill Johnson, Newsom said the bankruptcy resolution “must yield a radically restructured and transformed utility that is responsible and accountable.” He called for a better financial plan, clearly defined safety metrics and a “streamlined process” for a state or third-party takeover if warranted. He also said he doesn’t expect that the post-confirmation board will include any current directors.

PG&E said its plan meets state law and “is the best course forward for all stakeholders.”

“We’ve welcomed feedback from all stakeholders throughout these proceedings and will continue to work diligently in the coming days to resolve any issues that may arise,” the company said in a statement Friday.

Under the settlement agreement, the company has to modify the plan in a manner “acceptable to the governor” by Tuesday.

Political Pressure

Newsom, who took office just weeks before PG&E filed the largest-ever utility bankruptcy in January, faces political pressure to show dramatic changes. The company’s role in deadly wildfires has provoked widespread public outrage, which was exacerbated in October after a series of mass blackouts designed to keep its power lines from sparking wildfires during dry, windy conditions. The governor threatened a state takeover of the company after the outages if it couldn’t improve its operations.

“After the company exits bankruptcy, Newsom really needs it to succeed,” Ellias said. “It could put his entire career as governor in jeopardy if this company isn’t successful.”

A recent poll by the University of California at Berkeley showed that a majority of the state’s voters are in favor of changing the way PG&E operates, with one-third wanting an end to it as an investor-owned utility.

Already, a California lawmaker is planning to introduce legislation that would turn PG&E into a government-owned utility. And a group of mayors and local officials have floated a proposal to make it a customer-owned cooperative.

Rival Bid

Newsom’s demands could give activist investor Elliott Management Corp. and Pacific Investment Management Co. another shot at rallying support around a rival restructuring plan. They’re leading a group of bondholders that have offered to inject $20 billion in cash into PG&E in exchange for most of the equity in the company.

In a statement Thursday, Elliott blasted PG&E’s own restructuring proposal, saying it would saddle the company with an additional $10 billion in debt, limit its safety investments and turn the utility into a “junk-bond issuer.”

In his letter, Newsom raised similar concerns that PG&E’s debt-heavy plan wouldn’t allow for the company to make billions of dollars of needed safety investments.

“All of this contributes to a reorganized company, that, in my judgment, will not be positioned to provide safe, reliable, affordable electric service,” he said.