Decades from now, when we look back at the critical minerals that shaped the 2020’s, lithium will dominate the conversation.

This alkali metal has captured global attention as an emphasis on cleaner, greener, renewable energy and the rise of electric vehicles earns it the moniker ‘white gold’.

Amid a concerted global effort to move towards carbon neutrality, demand for lithium continues to rise. But with a supply crunch looming, emerging players are in the spotlight.

Towards Net Zero reports that demand for lithium could grow to more than 40 times current levels if the world is to meet its Paris Agreement goals. But where does Australia sit in this burgeoning industry, and how are ASX-listers positioned to respond?

Give me the elevator pitch

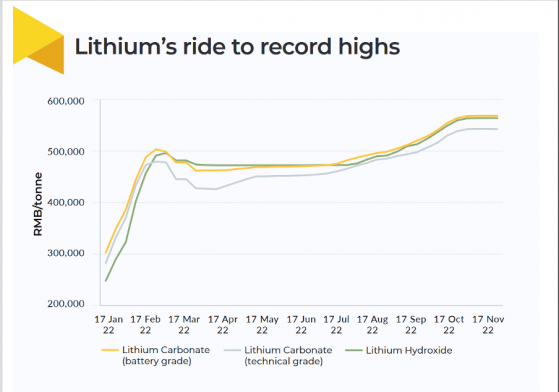

2022 was far and away a banner year for lithium, characterised by meteoric price hikes and soaring demand among battery makers and EV giants.

A deepening supply deficit was the catalyst for triple-digit gains last January but the market stabilised in subsequent months.

Source: Benchmark Minerals.

Looking at the big picture, Benchmark Minerals reports that lithium carbonate prices rose 114% between January and November, spurred on by reignited demand in the last three months of 2022.

Lithium’s rise makes sense when tracked alongside burgeoning EV demand. S&P Global reports that EV sales more than doubled in 2021, while 6.5 million vehicles hit the road last year. By 2025, that number is expected to balloon to 10.5 million.

However, while the firm’s Commodity Insights team said markets were expanding in the Americas and Australia, soaring prices and a continued lack of supply through 2030 may decelerate the energy transition, threatening EV sales and adoption.

“Despite COVID, EV sales accelerated globally much faster than expected in the past year and went into hyperdrive,” metals pricing director Scott Yarham explained.

“As a result, lithium demand, which is essential for EV batteries, is growing much faster than lithium supply, creating a market disconnect.”

Long story short: even though lithium’s current momentum can’t hold a candle to the stellar January gains, this critical mineral is still on the up.

In the spotlight: ASX lithium stocks

Ioneer

Ioneer Ltd (ASX:INR, OTC:GSCCF) closed out 2022 with a big announcement: it was in line for a loan of up to US$700 million from the US Department of Energy.

If received, the funding runway will support development at the Rhyolite Ridge Lithium-Boron Project in Nevada, which has just entered the final stage of permitting.

Managing director Bernard Rowe said the conditional loan commitment came at a crucial time for Ioneer.

“I regard this as the most significant milestone in the history of the company and a testament to the countless hours of hard work by the Ioneer team over the past six years,” he explained.

“Our project is uniquely positioned in the US, and has been engineered to ensure a stable, long-term, environmentally sustainable source of lithium.

“Now, with conditional debt and equity commitments of nearly US$1.2 billion, we are well positioned to commence construction upon receipt of final permitting.”

Core Lithium

Core Lithium Ltd (ASX:CXO) finished the year with a busy three months, characterised by mining and commissioning work at its Finiss Lithium Project and a A$100 million placement.

The Northern Territory lithium stock officially opened the Finniss mine in October, giving the Northern Territory Government, customers, community members and other key stakeholders a chance to see the lithium hub in action.

Northern Territory Government Deputy Chief Minister and Minister for Mining and Industry Nicole Manison and Core Lithium chair Greg English.

The company also shipped 150,000 dry metric tonnes (dmt) of direct shipping ore from the Darwin Port last quarter, averaging a 1.4% lithium oxide grade and fetching US$951 per dmt.

Beyond the shipment, Core commissioned its crushing and screening plant and awarded a five-year operations and maintenance contract to engineering firm Primero.

CEO Gareth Manderson said the team continued to reach key milestones over the December quarter.

“The Finniss operations team are managing the weather impacts experienced from Tropical Cyclone Ellie that brought above average rainfall during December,” he explained.

“We continue to refine our approach to manage the impacts of wet season events and remain on track for commissioning of the concentrator with our key contracting partners.”

Jindalee Resources

Jindalee Resources Ltd (ASX:JRL) spent 2022’s final quarter conducting resource drilling and metallurgy work at its McDermitt Lithium Project in the US.

The explorer drilled 21 holes at McDermitt last quarter, returning numerous, wide lithium hits from shallow depths. The highlights include:

- 182.2 metres at 1,197 parts per million (ppm) lithium from 21.4 metres;

- 131.6 metres at 1,219 ppm from 21.9 metres;

- 68.6 metres at 1,669 ppm from surface; and

- 50.3 metres at 1,512 ppm from surface.

Since the drill program, Jindalee has lodged a plan of operations that covers the next scope of exploration work. It also plans to release an updated resource this quarter.

On the corporate front, the lithium stock spun out its Australian assets into Dynamic Metals Ltd (ASX:DYM) and celebrated its A$7 million initial public offering.

Looking ahead, Jindalee has A$5.3 million in the bank to support its future endeavours.

Lake Resources

Lake Resources NL (ASX:LKE, OTCQB:LLKKF) continued to make strides at its flagship Kachi Lithium Project in the US, doubling its mineral resource following an extensive drilling program.

The lithium camp is now reported to host 2.2 million tonnes worth of lithium carbonate equivalent in the measured and indicated resource categories, along with a further 3.1 million tonnes in inferred resources.

Drilling at the Kachi project.

Following demonstration plant testing, the company is tracking to release some key development documents (including a definitive feasibility study) later this year.

Beyond Kachi, Lake spent the December quarter strengthening its executive team and recruiting senior vice presidents to handle technology, strategy, risk, investor relations and communications.

The clean lithium pundit also appointed a chief legal officer and general counsel and added sector-leading industry, capital markets and governance expertise to its board

Lake had A$133 million in the bank and no debt at the end of 2022.

Lightning Minerals

The December quarter proved busy for ASX newcomer Lightning Minerals Ltd (ASX:L1M), which hit the boards following an A$7 million initial public offering.

The lithium stock hit the ground running at a soil sampling and geophysics program over its flagship Dundas project in WA, where multiple pegmatite intrusion outcrops have been identified.

Pegmatite outcrop (white) intruding mafic host lithology.

Since the field program wrapped, Lightning has sent rock chip and soil samples to the lab for analysis, with results set to underpin drill target identification this quarter.

Lightning has also recruited an exploration manager to oversee the work programs, and it finished the quarter with A$6.2 million in the bank.

Green Technology Metals

Green Technology Metals Ltd (ASX:GT1) spent the December quarter consolidating project ownership and drilling out its Ontario lithium assets.

Four rigs are now working day and night at the flagship Seymour and Root projects — the latter of which is becoming “bigger, thicker and higher-grade” than GT1 expected thanks to a large-scale exploration target.

The company hopes to release a maiden resource for Root this quarter, while further exploration and drill results from Seymour are due shortly.

CEO Luke Cox said: “The December quarter has highlighted significant progress GT1 continue to make as we drive forward our two key lithium projects, Seymour and Root.

“We have now moved to 100% ownership of all our projects and extinguished the royalty on the Root project, a significant de-risking milestone achieved as we continue to build a pre-eminent vertically integrated lithium business in Ontario.

“We look forward to the next quarter as we continue to expand our team in Canada and drive forward the development of our high-grade lithium projects.”

Alchemy Resources

Alchemy Resources Ltd (ASX:ALY) is hunting for gold and lithium at its Karonie and Lake Rebecca projects in WA.

The company spent the December quarter progressing exploration on multiple fronts, with work including drill programs, gravity surveys, regional exploration and mapping to get a better sense of the mineralised potential at both camps.

First-pass reverse circulation drilling was the priority at the wholly-owned Karonie project, with work unearthing pegmatite zones measuring up to 27 metres in downhole thickness.

Meanwhile, at the Lake Rebecca asset, Alchemy focused on a first-pass regional program that encompassed reconnaissance sampling, mapping and targeting work.

Pegmatites and granite dykes at Lake Rebecca.

Lithium Power International

Lithium Power International had a lot on the to-do list heading into 2022’s final quarter.

It consolidated ownership of the cornerstone Maricunga Lithium Project, produced battery-grade lithium carbonate with 99.99% purity, acquired the project’s water rights and kicked off reverse circulation and diamond drilling at the East Kirup lithium prospect in WA.

Freshwater borehole testing at Maricunga.

The company is still in project financing talks, backed by global financial services firm Canaccord Genuity (TSX:CF, LSE:CF). While it’s still early days, LPI says its fielding strong interest from strategic investors, ECAs and government bodies to provide equity and debt funding.

Lithium Power International CEO Cristobal Garcia-Huidobro said of Maricunga’s potential: “We are confident that the competitive nature of our project, combined with our strong ESG principles and stage of advanced development, positions LPI favourably with strategic investors and international lenders.

“The interest received thus far underscores the strong technical and ESG profile of the Maricunga project.”

Xantippe Resources

Xantippe Resources Ltd (ASX:XTC, OTC:XTCPF) kept the wheels in motion at its flagship Carachi Pampa Lithium Project over the December quarter, completing key work programs and adjusting its board and management team to reflect its transformed operations.

At the start of this year, Xantippe closed in on a lithium-bearing brine zone during a geophysical survey. This buried salar deposit is open at depth and in all directions laterally, meaning it bears promise as an emerging exploration target.

Xantippe executive chair John Featherby said the finding propelled the company forward “with great confidence” ahead of its maiden drill program.

"The aim is to use this drilling to provide an initial JORC-compliant mineral resource estimate,” he explained.

Xantippe has already submitted its environmental impact assessment (EIA) to the local mining authority in a bid to secure an exploratory drilling permit. Once approval is in hand, the program will kick off straight away.

After its placement to institutional and professional investors raised A$12 million, the company has also extended its share purchase plan by three weeks to Friday, February 10.

Read more on Proactive Investors AU