Brookside Energy Ltd (ASX:BRK) managing director David Prentice is confident the company’s resilient business model of acquiring acreage and oil & gas producing properties in the prolific Anadarko Basin in Oklahoma, USA, has set the foundation for a strong 2021.

He told Proactive’s Energy Webinar this week that the company is focused around three pillars – operated drilling, producing property acquisition, and land and leasing.

He said: “When acreage prices run harder, you’re able to trade and transact your way into a larger acreage position.

“When acreage prices pull back, you take some of that working capital to acquire more acreage at lower prices.

“It’s a very resilient business model and something that we’re very proud of.”

To date, the company has acquired around 3,000 acres in the highly sought-after region.

Increasing acreage in Oklahoma

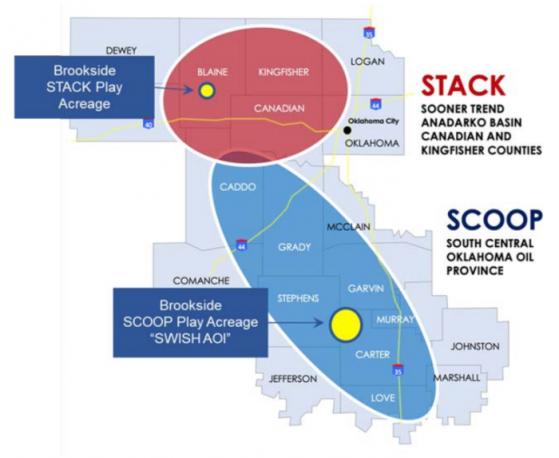

Prentice said: “We started out in the STACK play there in the north and have now focused 100% of our attention in the SWISH area of interest down in the SCOOP play in southern Oklahoma.

In the SWISH AOI, the company has a very large prospective resource of just over 11.5 million barrels of oil equivalent.

Prentice said: “The large prospective resource is all about acquiring premium acreage at the bottom of the cycle and giving us a chance to use that skill and our ability on the ground to identify these fantastic acreage positions at a time when perhaps the sector is being overlooked.”

The area is also highly sought after by major players including Devon Energy Corp (NYSE:DVN) (FRA:DY6) (BMV:DVN), EOG Resources Inc (NYSE:NYSE:EOG) (FRA:EO5)(VIE:EOGR) (BMV:EOG), Exxon Mobil Corporation (NYSE:NYSE:XOM) (FRA:XONA) (BMV:XOM) (ETR:XONA), Marathon Oil Corporation (NYSE:NYSE:MRO) (FRA:USS) (BMV:MRO), Ovintiv Inc (NYSE:OVV) (TSE:OVV) (FRA:47Q), and Continental Resources, Inc. (NYSE:CLR) (BMV:CLR) (FRA:C5L).

Low-risk SWISH production

Prentice said: “The Flash and the Courbet wells have really done particularly well in their first 6-9 months of production and that really underpins our whole internal rate of return and fast payout.

“There’s been A$350 million spent in the last two years just in that 35 square mile area just on drilling, so this has been the focus of a lot of attention from these large, well-capitalised companies in the last two years despite the pretty severe downturn that we’ve seen across the oil and gas sector.

“From here, our drilling activity in the SWISH area is really now about exploitation not exploration.

“We’re not hoping to find a decent well - we’re drilling in areas where we know the formation is productive - and we’re using modern, horizontal drilling and completion techniques to more efficiently get at that oil and gas that we can measure in the formations.

“It’s low risk and very high return.”

SCOOP and STACK Plays in the Anadarko Basin, Oklahoma

First operated well

Prentice said that, based on a $40 oil price and a $2.5 natural gas price, there was around US$65 million of net present value in the ground.

He said: “There’s a lot of value there for us and we’re focused on unlocking that value in the first quarter of next year with our first operated well.

“To give you some idea of how well these wells perform, even at those modest commodity prices and where we are in the cycle today, these wells generate an internal rate of return of about 40% and achieve payout in less than two years.

“So that horizontal well is going to be a key catalyst for us going forward.”

Southern SCOOP position

The company also has two stacked productive formations in the highly sought-after Sycamore-Woodford trend and has secured operations on three drilling spacing units in that area - the Rangers, Flames and the Jewell well.

Prentice said: “The Jewell well will be the first well to spud early next year and on the back of that, that sets up a five year 20 well drilling inventory that will be a company maker for Brookside.”

Producing property acquisition pillar

In 2020, the company pushed its producing property and acquisition pillar at a time in the cycle where valuations on producing properties were at multi-decade lows.

The company has made three successful property acquisitions as part of the Orion Project Joint Venture with Stonehorse Energy Limited (ASX:SHE) and Black Mesa Energy, which operates the JV.

Prentice said: “We’ve acquired the Newberry, Mitchell and Thelma wells and the Newberry and Mitchell wells are now in production and the Thelma well is currently testing.

“These are relatively modest acquisitions but are high impact in terms of reserve value and most importantly, production and cashflow.”

The company’s low-risk business model.

Looking forward

The company is confident its gathering momentum across all three pillars leading into 2021.

Prentice said: “The concept of premium acreage is key because you get good rates of return whether you’re trading the acreage or you’re intending to drill it and produce it.

“You get good rates of return right the way through the commodity price cycle and then when things turn, as we expect they will into 2021, you’ll see valuations increase rapidly across all three of these pillars of our business.”

Heading into 2021 Prentice believes the outlook looks good both for the sector and the company.

He said: “Our stock price has followed the macro picture rather than really reflecting the value that we have created during the last 12 months.

“I think people will start to look at our $65 million of net present value in the ground and see there’s a well actually being drilled now, and our company has got a market cap of $10 million and are going to bring a well on at $1500 barrels a day of oil equivalent.

“I think the rest of it speaks for itself.”

Read more on Proactive Investors AU