(Bloomberg) -- After a crucial week for the Bank of England, a November interest-rate increase no longer looks like a sure thing.

Inflation may have hit 3 percent, but for some policy makers at the central bank, the domestic price pressures that justify raising now aren’t there. That view was backed up by data Wednesday that showed wage growth slowing.

Dave Ramsden, the Monetary Policy Committee’s newest member, had said a day earlier that he wasn’t in the majority at last month’s meeting on the need for a hike in coming months. His fellow BOE deputy governor Jon Cunliffe added his voice to the dovish view on Thursday. While Cunliffe is “very clear” a gradual tightening is warranted it the economy continues as expected, he’s less set on the timing.

“For me, when that process starts is a more open question and my decision will be based in large part on whether I see domestic inflation pressures and what I start to see happening to pay in the economy.”

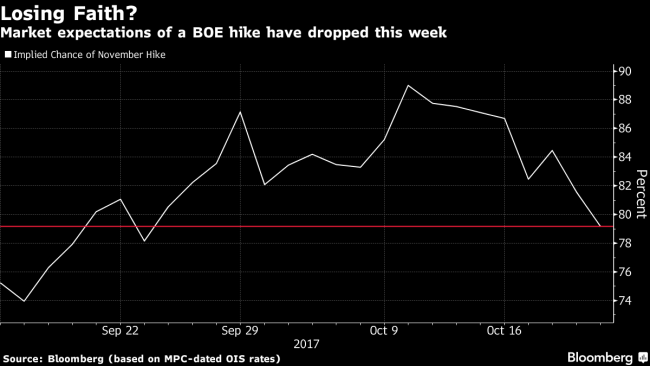

Those dovish notes haven’t gone unnoticed. While traders are still pricing in an 78 percent chance of a 25-basis point rate increase on Nov. 2, that’s the lowest level since late September and down from 87 percent at the end of last week. The pound has also dropped, and is now below levels seen before the last policy meeting, which triggered the heightened bets on a hike.

The comments came in a week that also saw the release of key data on consumer prices and the labor market, as well as figures on retail sales and the public finances. Inflation reached the fastest in five years in September, and is now 1 percentage point above the BOE’s target. But basic wage growth slipped back to 2.1 percent, keeping pressure on consumer finances, and underlying retail-sales growth slowed.

“Measures of domestically generated inflation are consistent with there still being some slack in the economy,” Ramsden told U.K. lawmakers on Tuesday.

In between all that, Governor Mark Carney offered his latest view, sticking to the line that a rate increase would probably be appropriate in the “coming months.” Even those comments imply November isn’t set in stone. His colleague Silvana Tenreyro said while the U.K. was nearing a “tipping point” on policy, she wanted to see how the data pan out.

“The week’s economic news injected caution into expectations that the MPC will raise bank rate in its November meeting,” Martin Beck at Oxford Economics wrote in a note on Friday. “The committee is perhaps on more of a knife-edge than appeared to be the case.”

Credibility Question

More than three-quarters of economists in Bloomberg’s monthly survey -- conducted before this week’s data -- expect the BOE to lift its key rate to 0.5 percent next month. While that may still happen, a split vote rather than a unanimous decision on the nine-member MPC is now seen as likely.

With expectations for a hike next month higher than before any meeting in recent years, a failure to act could be a blow to Carney’s credibility, already seen as stretched in some circles. The governor has drawn criticism in the past for sending mixed messages to investors on the timing of rate increases, with one lawmaker branding him an “unreliable boyfriend” in 2014 -- a label that has stuck with him ever since.

(Updates with Oxford Economics in ninth paragraph.)