Blue Star Helium Ltd (ASX:BNL) has played to its strengths in oil and gas with its pure-play helium strategy.

Historically, helium has been extracted as a by-product of natural gas production but with recent increases in helium prices and declines in natural gas prices, companies like Blue Star are actively exploring for the commodity – transferring its oil and gas industry knowledge in North America.

Blue Star managing director Joanne Kendrick said: “Helium is explored for and developed in almost the same way as oil and gas, so it played to our technical strengths as a company and we made a deliberate decision to diversify into helium.

“Helium was a moving market; it was a high-tech commodity with growing demand and outran our oil and gas strategy, so we decided to become a first mover pure-play in helium.”

Increased demand for helium

Helium is a unique industrial gas which, due to its unique chemical and physical qualities, is a vital element in the manufacture of MRIs and semiconductors.

The gas is also critical for fibre optic cable manufacturing, hard disc manufacturing and cooling, space exploration, rocketry, lifting and high‐level science.

Kendrick said the demand for helium, which had substantially grown in the last decade, was expected to continue to grow due to the unique ways it was used.

She said: “It’s also used by big tech companies like Netflix (NASDAQ:NFLX), Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) to cool their cloud-based servers.

“And another use, which has been growing more significantly of late, has been in rocketry and space exploration.

“It’s a commodity that can’t be substituted out - so the demand is inelastic.”

High price commodity

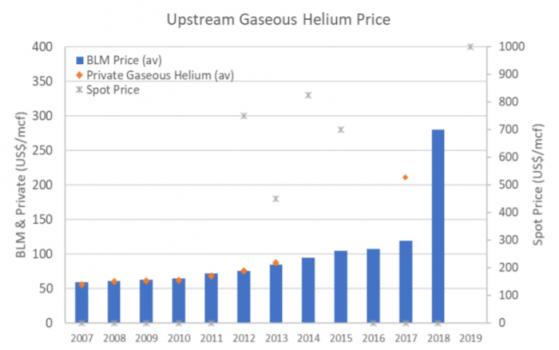

As a result of the demand, and the inability to artificially manufacture helium, the current contractual market for helium in the US is between US$200-US$300/thousand standard cubic feet, and Blue Star is confident there are likely spot prices above that level at around US$400/thousand.

Notably, COVID-19 is a significant disruption which adds difficulty to forecasting.

A recent report by Independent Investment Research has assumed US$200/thousand standard cubic feet in its indicative financial model, which the analyst believed is conservative enough to avoid potential for disappointment and leaves room to achieve higher prices.

Kendrick said: “Helium is an exciting commodity, it’s highly-priced, it’s in short supply and we expect that deficit in supply to continue especially as we recover from COVID.”

Sources: BLM, Edison Research, Kornbluth.

Prospective resource potential

In the June quarter, the company announced its maiden prospective resource of 3 BCF P50 prospective resource (recoverable helium, net of royalties) in its Enterprise and Galileo prospects in Colorado.

Kendrick said: “Our strategy is to be a finder and developer of new supplies of helium to deliver into the market.

“We recently had an independent prospective resource report on the first two of 11 prospects in our portfolio which were independently certified at 3 billion cubic feet of recoverable helium at a mid-case or P50 level.”

In addition, engineering estimates have confirmed a very low-cost proof of concept well at US$300,000 for dry hole costs.

Kendrick said: “When you put that in context of the potential in-ground value of that 3 billion cubic feet of helium, you can see there’s quite a considerable uplift in value there.”

These prospects are in a prime position in North America, which has excellent infrastructure, drilling and logistical services available due to its long-standing oil and gas industry.

Dominant land position

Kendrick said the company was looking to consolidate its land position in the “incredibly prospective region” of Las Animas where it held around 130,000 gross acres across 11 prospects and leads.

She said: “In Las Animas, we have one confirmed field which produced pre-World War II which is what keyed us into this area.

“This is a proven play and we’re confident that where one has been found more will be found because it’s highly unusual in an oil and gas context, and even a helium context, to have just one discovery in a prospective area.

“We’re looking to add to that and consolidate our land position over prospects in addition to the Enterprise and Galileo prospects.”

Blue Star’s landholding across Las Animas, Colorado, USA.

Prospectivity proven

The company’s prospects are in the Lyons Formation Helium Play, which is proven in the area by the historical Model Dome field.

Model Dome also has a proven higher concentration of helium of 8%, compared to the 90% of global production of helium which produces around 0.1%.

Kendrick said: “Model Dome has proven higher concentrations of helium in the area and that has flow-on effects to margin in any ultimate production.

“We’ve proven that we’ve got a competent and valid seal over our target reservoir because we’ve contained helium at Model Dome, and we can see in well logs and petrophysics that that seal is extensive.

“We also see from Model Dome and other wells in the area that we have an excellent reservoir that is highly productive for its depth.”

This makes for relatively high production rates per well which means lower capital-intensive development and a higher margin in terms of productivity on a per field basis.

Kendrick said: “All of those things add up to confirming the prospectivity of the area in and around Model Dome and extending that play across Las Animas and the rest of our acreage where we’ve been targeting our land acquisitions.”

Quarter four drilling

The company has staked the first well location at Enterprise, with the intention to drill in the fourth quarter of this year.

Kendrick said: “We’ve got a low-cost concept drilling program coming up within the next quarter, so we’ve got some immediate short-term value drivers.

“And then we have scale and room to grow, and we’re working hard to add more wells and more prospects into that drilling program to give ourselves the best chance of a positive strike.

“We’ve got an exciting few months coming up and helium is a high tech, high price commodity – and we’re excited to get out and find some.”

Following on from any drilling success, Blue Star is well placed to pursue low-cost production in a short time frame.