Bitcoin’s propensity for wild mood swings for the most fickle of reasons was on full display on Wednesday.

The world’s largest cryptocurrency plummeted more than 4.5% after crypto-focused financial services platform Matrixport published an article titled ‘Why the SEC Will Reject the Upcoming Spot BTC ETF Applications’.

Matrixport contended that the spate of applications filed by BlackRock (NYSE:BLK), VanEck, Grayscale, Ark Invest and others to have their bitcoin-based exchange-traded funds (ETFs) approved for trading “fall short of a critical requirement that must be met” before the Securities and Exchange Commission (SEC) gives the nod.

Bitcoin tanked on the spot markets as a result, despite this being an opinion in an otherwise bullish research piece.

It underscores the volatility inherent in the cryptocurrency markets, in which traders can be easily swayed for seemingly innocuous reasons.

Senior ETF analyst for Bloomberg Eric Balchunas took Matrixport author Markus Thielen to task on the report, tweeting: “Hi Markus saw the ‘rejection’ prediction just curious are you basing this off any sourcing (eg issuers or inside the SEC) or is it more just your opinion/take on things? Thanks.”

Thielen doubled down, saying he believes the SEC will vote down the approvals.

Regardless of the outcome of these pending ETF approvals (or denials), the situation exposes the relative immaturity of bitcoin as an asset class.

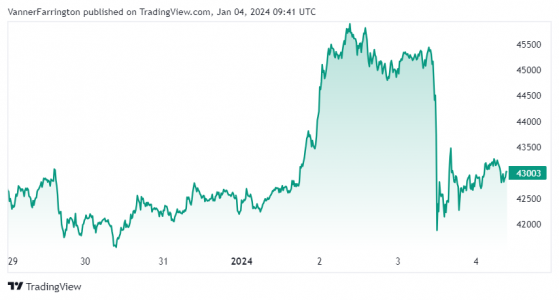

Bitcoin dropped as low as $40,750 from an intraday high of $45,500, but has since recovered to $42,960 at the time of writing.

Bitcoin’s week-on-week performance shows volatile behaviour – Source: tradingview.com

Ethereum (ETH) suffered its worst session in five months, tanking more than 6% to close Wednesday at $2,209.

The ETH/USD pair has slightly recovered since and was swapping for $2,224 at the time of writing.

Bearishness struck the wider altcoin space too, with Solana (SOL), Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE) and Ripple (XRP) all tanking between 9% and 11% overnight.

Global cryptocurrency market capitalisation currently stands at $1.65 trillion, with bitcoin dominance above 52.5%.

Read more on Proactive Investors AU