Highlights

- Aussie Broadband Ltd (ASX:ABB) shared its trading update for fourth quarter of financial year 2022 today (August 1).

- The company has recorded some significant increases in its broadband service figures.

- Aussie Broadband’s shares were 17.36% down at AU$3.00 each on ASX at 12.33 PM AEST.

Telecommunications services and products provider Aussie Broadband Limited (ASX:ABB) today (August 1, 2022) shared its trading update for the fourth quarter of the financial year 2022.

On the back of the news, shares of Aussie Broadband were trading 17.36% lower at AU$3.00 each on ASX at 12.33 PM AEST.

Despite recording significant increases in its broadband service figures, the company's shares were trading lower.

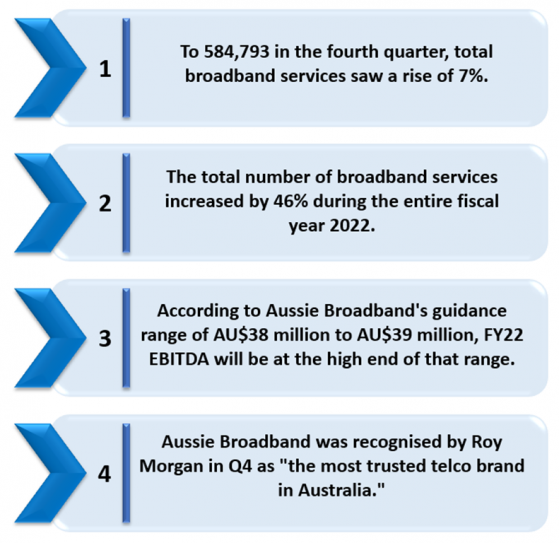

Key highlights of 4QFY22

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 01 August 2022

In fourth point: It should be the Telecom firm was

Other updates during the quarter

Broadband usage increased significantly across all market segments, with residential broadband services rising 28% to 464,979 and commercial broadband services rising 68% to 59,488. The numbers also include the services offered by Over the Wire, which Aussie Broadband had purchased earlier this year.Aussie Broadband's wholesale and white label broadband services also increased to 60,326, and NBN services (excluding Satellite) to 6.46% from 4.74% in 4Q FY21, the company informed in the ASX filing.

With over 105 of the 121 NBN Points of Interconnect links moved to the Aussie fibre network and 100G regional Telstra wavelength network, the 90% full fibre project is estimated to save AU$13.5 million per year in costs.

Data Source- Company announcement dated 01 August 2022

FY22 EBITDA guidance

The Aussie Broadband group (including the contribution from Over the Wire after acquisition) anticipates EBITDA to be generated at the upper end of the current projection range of AU$38 million to AU$39 million based on unaudited financials.

The company will provide additional details on Aussie Broadband's operating and financial results for FY22 and its outlook for FY23 and beyond on 29 August 2022.