Aurumin Limited (ASX:AUN) is confident that its exploration plans for 2021 will help spark a revival of the historical Mt Dimer and Mt Palmer gold projects in Western Australia.

The company successfully listed on the ASX on December 9, 2020, following a fully subscribed $7 million Initial Public Offer (IPO).

Managing director Brad Valiukas said: “The best place to find gold is generally a gold mine. These are both historical production projects and we are quite optimistic about being able to build on those projects and those resources.”

“We are extremely experienced operators and developers and we have the capacity to take these projects all the way through to development.”

The company raised money in its IPO to fund exploration at the projects and earlier this month commenced a 50 hole, 5000-metre, reverse circulation (RC) drilling program at Mt Dimer.

Mt Dimer drilling

This program follows results from a 2020 SAM (ground-based Sub-Audio Magnetic) survey over the Lightning, Golden Slipper and Frodo areas which identified 13 primary targets analogous to current known mineralisation positions, including the unmined Lightning deposit.

Valiukas said: “This time last year we made a decision to go and list on the ASX and Mt Dimer was a big part of that.”

“Our belief was that if we got the money to drill then we’d have really good opportunities to repeat at least once - if not potentially multiple times over - what’s been done there before in terms of production and grade.”

“Mt Dimer produced 125,000 ounces at 6.4 g/t and we’ll be looking to build a resource many times over that and set it up to come back into production at some stage.”

Lighting and Golden Slipper deposits

Aurumin is confident that Mt Dimer has considerable upside and the potential for multiple open pits, in addition to the known high-grade Lightning and Golden Slipper deposits.

The SAM survey covered a relatively small survey area of the granted mining tenements and a much a larger footprint is available to be tested in the future.

Valiukas said: “Lightning, which is unmined, is relatively short but high-grade and was discovered by accident when they were drilling out the waste dump for Golden Slipper – that’s the best indication I can give about how seriously it appears exploration was taken at that time!”

“We think that with a little bit of smarts and concentrated effort, we can produce something good up there.

“This drilling that we’ve just started will tell us that one way or another, but we are very optimistic – we’ve got the IPO funds but we’ve also put a lot of money into this ourselves and we’re reasonably comfortable in terms of what will come out of it.”

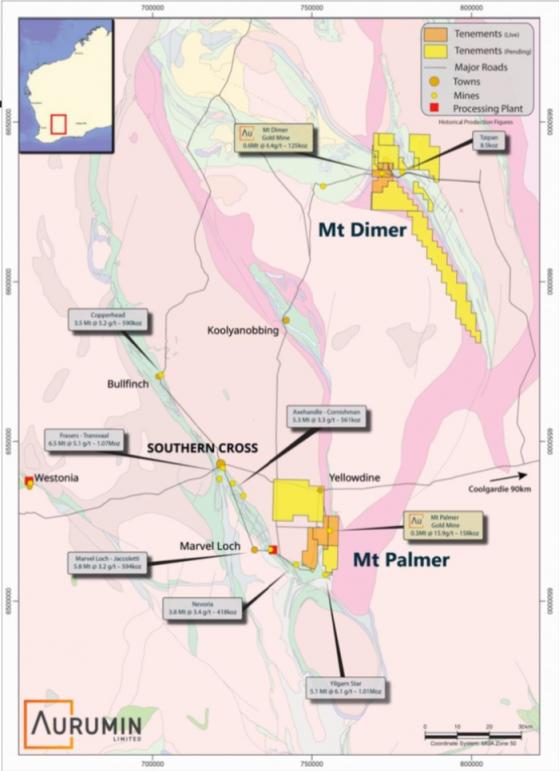

The company’s two historical gold projects in Western Australia.

Building a bigger footprint

During the half year to December 31, 2020, the company applied for additional tenements covering more than 324 square kilometres to expand the Mt Dimer footprint.

Tenements were applied for based on potential for mineralisation to occur proximal to the granite-greenstone contact, particularly where low-level soil anomalism was identified in historical surveys.

Valiukas said: “Overall we’re looking to grow the footprint, and that’s on the basis that we’ll turn Mt Dimer back into a production centre.”

“We’ve got a pipeline of projects not just for now but for the long-term.”

“We’ve picked up the ground where we think there’s potential and as we test, we’ll continue to expand on what was a historical mine.”

“Building a bigger footprint is a long-term play.”

Mt Palmer potential

The company has also been hard at work compiling and assessing historical geological data to finalise a drill program at the high-grade Mt Palmer Project. The mine historically produced 158,000 ounces at 15.9 g/t from a single pit and underground and sits on 15 kilometres of greenstone strike.

Valiukas said: “Mt Palmer has produced more gold than Mt Dimer at a higher grade but it has sat there and had little done since about 1944 – it was largely forgotten.”

“Similar to Mt Dimer, we will start in and around the mine and work our way out, focusing on the greenstone trend which has numerous old workings along it.”

“The mine historically produced 158,000 ounces at 15.9 g/t and we are looking for multiple replications of that.”

Looking forward

The company expects to release the first results from drilling at Mt Dimer in the near-term.

Valiukas said: “Our short-term focus is hopefully putting out some good drill results late April, underpinning the company’s activities for the next 12 months on an exploration basis.”

“When we went through the IPO process we said we were going to spend most of the money at Mt Dimer, which we’re on track to do.”

“We also allocated $900,000 of the $7 million raising to mergers and acquisitions identification and assessment.”

“Our group comprises very experienced developers and operators; we think we’ve got a lot to offer and can handle a lot more scale than just these two projects.”

“Nothing will take away from these projects, we raised money in the IPO to do these and with success we’ll go even harder, but we can definitely handle more.”