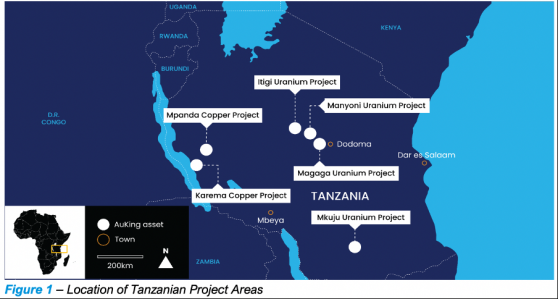

AuKing Mining Ltd (ASX:AKN) has added a series of Tanzanian uranium and copper prospects to its portfolio, building its exposure to critical mineral and nuclear energy assets.

The explorer has just dotted the I’s and crossed the T’s on an acquisition that brings four uranium and two copper projects into the fold, with work on the key Manyoni and Mkuju projects to kick off immediately.

In October last year, AuKing flagged its intention to acquire 92 U for A$6 million, picking up its uranium and copper portfolio along the way.

Fast forward to today and AuKing has dispatched 60 million shares and 30 million options — exercisable at 20 cents before September 30, 2025 — to seal the deal.

The company will also award 5 million new shares and 10 million options to Vert Capital, which introduced the company to the Tanzanian assets.

Completion of this acquisition has seen AKN shares as much as 38.1% higher in the first hour of ASX trading to $0.145.

Strategic pivot into important sector

With the acquisition under its belt, AuKing CEO Paul Williams said the company would take an aggressive approach to exploration at its new Tanzanian uranium projects.

“Already this year, we’ve seen uranium prices push past US$50 per pound and demand is set to increase,” he explained.

“AuKing’s strategic pivot into this important energy sector commodity is a tremendous value-add for our company and its shareholders.

“We expect investor interest to grow as we work up these prospective uranium projects in coming weeks and months with plenty of news flow on the horizon,” he said.

Funding runway

When it first flagged the acquisition, AuKing also proposed a two-stage capital to raise around A$3.5 million.

The first tranche issued 13.7 million shares at 10 cents each, raising $1.37 million to support the company’s endeavours. A second tranche to make up the balance issued a further 21.3 million new shares.

The tranches also dispatched 6.9 million and 10.6 million options (exercisable at 20 cents before September 30, 2025) respectively.

What next?

Now that the acquisition has been completed, AuKing intends to take an aggressive approach towards its exploration program in Tanzania. Some of the highlights include:

- Mkuju – sampling and ground spectrometer surveys, follow-up field sampling and auger drilling and trenching;

- Manyoni – preparing an initial 2012 JORC resource estimate, reviewing existing data and preparing for further drilling to expand resources;

- Itigi/Magaga – developing initial sampling programs; and

- Mpanda/Karema – finalising initial site access, completing soil sampling and reviewing available historical data.

Read more on Proactive Investors AU