Anson Resources Ltd (ASX:ASN) has kicked off a geotechnical engineering study for a proposed lithium processing plant at its Green River Project in the Paradox Basin in southeastern Utah, USA.

The exploration company intends to purchase the privately-owned, industrial-use land, which is near its flagship Paradox Lithium Project.

Anson has completed the first phase of an environmental site assessment with no major issues identified.

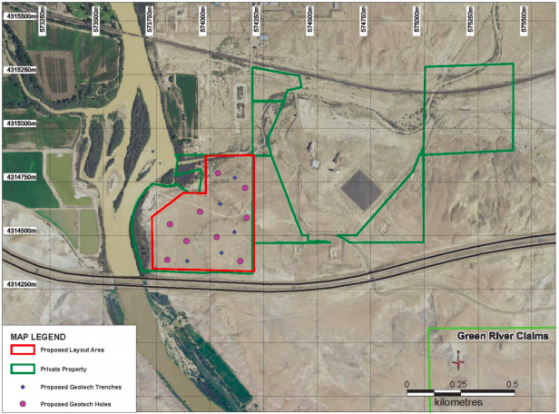

Plan showing the locations of the proposed boreholes and test pits.

The study will consist of core drilling and shallow trenching plus geophysical surveys, to provide data and subsurface conditions for possible construction locations within the property.

Independent engineers and geologists will lead the work consisting of nine boreholes and five test pits, from which the following will be collected:

- Core samples to a minimum depth of 70 feet and soil samples;

- Field resistivity measurements; and

- Dynamic properties of subsurface materials.

One of the Green River site trenches showing soils for foundations with shallow bedrock & dense gravels.

The study follows Anson’s signing of a letter of intent (LOI) earlier this month to acquire the 0.568 square kilometres of land less than 1 kilometre from its Green River Lithium Project.

The Green River landholding comprises 1,265 placer claims over an area of 106.2 square kilometres.

This land purchase will include water rights, as well as the oil and gas and mineral rights underlying the new landholding, and comes with easy access to the national rail network, interstate road system and gas and power infrastructure.

Concurrent exploration

The exploration at Green River will run in parallel with Anson’s core asset, the Paradox Project, which has a JORC resource of 1.04 million tonnes of lithium carbonate equivalent.

The close proximity of the projects will enable the company to leverage its experience and expertise in the region to fast-track exploration and mineral delineation for Green River.

Anson estimates a conceptual exploration target of 2.0-2.6 billion tonnes of brine, grading 100-150 parts per million (ppm) lithium and 2,000-3,000 ppm bromine at the project.

Read more on Proactive Investors AU