Alto Metals Ltd (ASX:AME) has fielded promising gold results from drilling at the Bull Oak deposit, at the company's wholly-owned Sandstone Gold Project in Western Australia.

The latest assay results pertain to the first four reverse circulation (RC) holes, part of an 18-hole RC program at Bull Oak, with a focus on exploring extensions to known gold mineralisation.

Significant gold results

Significant results from these initial holes include 55 metres at 1.5 grams of gold per tonne (g/t) from a depth of 127 metres, including 24 metres at 2.1 g/t gold from 148 metres.

Furthermore, a remarkable 1 metre at 21.1 g/t gold from 181 metres was recorded within an overall intersection of 172 metres at 0.64 g/t gold.

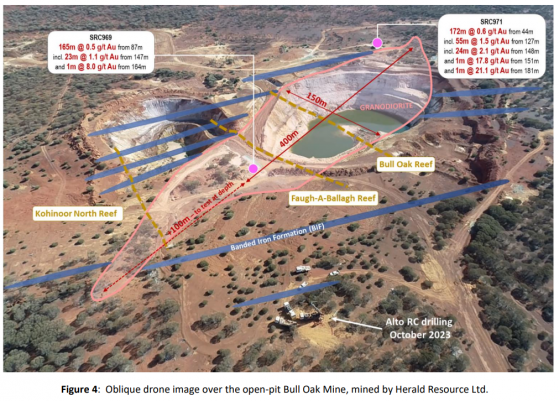

These results were obtained from hole SRC971, in the north-east part of the deposit.

Drill hole SRC969, drilled in the south-west section of the Bull Oak granodiorite, targeted mineralisation at greater depths below the current mineral resource.

It yielded notable results, including 23 metres at 1.1 g/t gold from 147 metres and 8 metres at 2.1 g/t gold from 157 metres, within an overall intercept of 227 metres at 0.44 g/t gold.

Shallow oxide gold intercepts were also identified, including 4 metres at 2.1 g/t gold from 48 metres.

Additionally, SRC968, one of the shallow vertical holes drilled outside the granodiorite, intersected quartz veining within oxide above fresh mafic rocks, returning 6 metres at 2.6 g/t gold from 32 metres, including 1 metre at 13.0 g/t gold from 32 metres.

Mineralisation remains open

These results confirm the presence of thick gold mineralisation at Bull Oak, with continuity established over a 400-metre strike, and the mineralisation remaining open.

The current mineral resource for Bull Oak stands at 65,000 ounces at 1.1 g/t gold, constrained within a A$2,500 pit shell.

Drilling has indicated that multiple stacked lodes extend for at least 400 metres along strike, and mineralisation continues to the south-west, extending toward the margin of the granodiorite.

This presents an exciting opportunity to define further high-grade mineralisation in future resource updates.

Managing director Matthew Bowles said: “These first few intercepts from below the shallow mined Bull Oak pit have confirmed the continuity of thick gold mineralisation over 400 metres of strike, outside the resource, and remains open.

"Importantly, the drilling has also demonstrated that mineralisation is not constrained to the granodiorite but also extends into the surrounding rocks, highlighting the potential for considerable near-term growth within a larger, single pit.

Low cost

"Our low-cost, targeted exploration is continuing to deliver as we focus on growing our existing resource base and advancing regional prospects. We have a number of additional assays still pending from Bull Oak and with drilling ongoing at regional targets, shareholders can look forward to further news flow over the coming months.”

Alto Metals is actively engaged in low-cost exploration to expand its core resource base within the Alpha Domain and is poised to release further assay results from additional drilling at Bull Oak and regional prospects in the coming months.

Read more on Proactive Investors AU