Aeris Resources Ltd (ASX:AIS, OTC:ARSRF), an established Australian copper-gold producer and explorer, has launched a fully underwritten equity raising of approximately A$30 million, aimed at bolstering its financial position and supporting general working capital needs.

The company’s capital raising exercise comprises a A$13.9 million institutional placement and a 1 for 4.73 pro-rata accelerated non-renounceable entitlement offer.

This will result in the issue of approximately 273.03 million new ordinary shares at 11 cents per share, representing approximately 39.31% of the current issued capital of Aeris.

In a notable show of support, Washington H. Soul Pattinson, Aeris' largest shareholder with a 30.17% stake, has pledged up to A$12.3 million in backing.

This commitment could potentially elevate WHSP's shareholding in Aeris to a maximum of 33.21%.

Progress key growth opportunities

Aeris executive chairman Andre Labuschagne said: “Our focus for the rest of FY24 is to deliver on guidance at each of our three operating mines following the successful transition of Jaguar onto care and maintenance, and to progress our key growth opportunities in the portfolio: Stockman, Constellation and Jaguar.

“The Mt Colin operation is performing ahead of plan year-to-date at an ore production level but tolling arrangements for treating the ore have recently resulted in a build-up of ore stocks, with over 110,000 tonnes stockpiled at the end of October, deferring receipt of revenue and stretching the working capital position of the business.

“Whilst Mt Colin is forecast to continue producing strongly through to the end of FY24, the timing between future toll processing slots could result in ore stock buildups again.

“So that we can maintain the momentum on our multiple growth projects through to the end of FY24 we believe that it is prudent to improve our working capital flexibility during this period with additional equity.”

Equity raising

The equity raising will be conducted through the placement and entitlement offer, resulting in the issue of approximately 273.03 million new ordinary shares.

The offer price of A$0.11 per new share represents a:

- 21% discount to Theoretical Ex Rights Price (‘TERP’) of A$0.14 based on the last closing price on November 24, 2023; and

- 27% discount to the last closing price of $0.15 on November 24, 2023.

Under the entitlement offer, eligible shareholders are invited to subscribe for 1 new share for every 4.73 existing shares held at 7:00 pm (Sydney, Australia time zone) on November 29, 2023.

This equity-raising initiative is fully underwritten by Jefferies (Australia) Pty Ltd and Bell Potter Securities Limited.

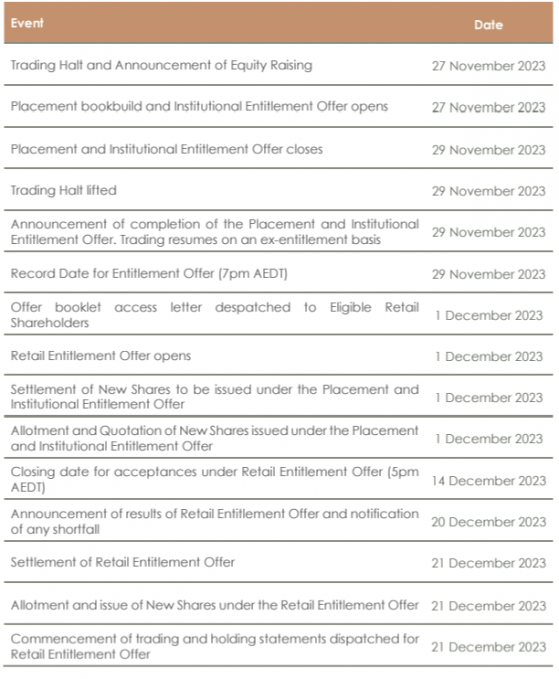

Indicative timetable.

Read more on Proactive Investors AU