In a substantial update to its mineral resource estimate (MRE), Aeris Resources Ltd (ASX:AIS, OTC:ARSRF) has revealed a notable surge in the copper and gold grades at its Avoca Tank deposit, situated within its Tritton Tenement package in New South Wales.

The updated MRE reveals 720,000 tonnes at a copper grade of 3.4%, gold at 1.1 grams per tonne (g/t), and silver at 17 g/t, signifying a 35% increase in copper grade and a 31% jump in gold grade.

In addition, the MRE also highlighted a 16% increase in contained copper metal and a 9% increase in contained gold metal.

After the upgrade, the Tritton tenement package now contains 24,000 tonnes copper metal, 24,000 ounces of gold metal, and 382,000 ounces of silver metal.

Furthermore, the updated MRE has extended the resource to 430 metres below surface, and mineralisation at Avoca Tank remains open down-plunge.

Significant potential to increase MRE

Aeris executive chairman Andre Labuschagne said: “Avoca Tank continues to improve as we get a better understanding of the geology.

“The 35% increase in the copper grade to 3.4% aligns with initial production from the mine and contributes to the overall improving grade profile at Tritton.

“Avoca Tank also remains open down-plunge, providing significant potential to increase the MRE with further drilling at depth.”

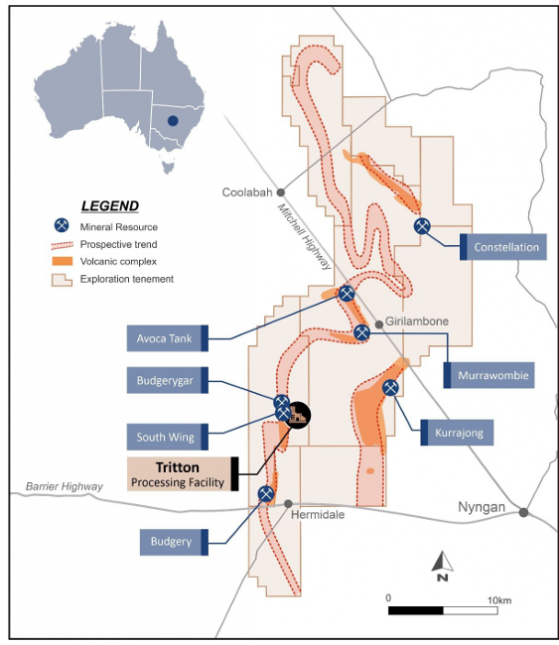

Location map showing the Tritton Tenement Package.

MRE update

The additional drilling and underground mapping completed since the 2013 MRE has led to a material increase in the total reportable MRE figures, including:

- 35% increase in copper grade and 31% increase in gold grade;

- 16% increase in contained copper tonnes and a 9% increase in contained gold ounces; and

- 15% decrease in tonnes.

The increased copper and gold metal is partly due to a revised interpretation based on substantially more geological information gained since 2013, and partly due to additional drilling that has extended the limits of the known mineralisation.

The increased geological understanding has facilitated the construction of more selective mineralised domains, which in places exclude low-grade intersections.

The updated interpretation is the primary reason why the October 2023 MRE reports higher grades and fewer tonnes in comparison to the previous MRE.

Forward plan

Underground diamond drilling will continue at Avoca Tank, initially focused on further grade control drilling to de-risk upcoming mining fronts.

Resource extension drilling will toward the end of FY24 targeting mineralisation below the base of the current MRE.

Read more on Proactive Investors AU