(Bloomberg) -- Hong Kong stocks extended declines, threatening to derail what had been a dramatic comeback in its equity market as another slump in global tech darkened sentiment.

The Hang Seng Index fell 1.8 percent by the midday break Tuesday, tracking losses in the Nasdaq 100 Index overnight, with technology and pharma stocks among the biggest losers. A gauge of China stocks fell 1.6 percent, led by CSPC Pharmaceutical Group Ltd.

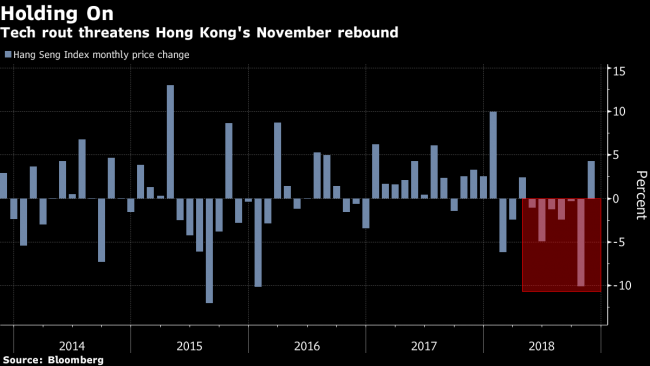

Hong Kong’s equity benchmark had advanced 5.6 percent in November through Monday, rebounding from its worst streak of monthly losses in 36 years. Its month-to-month turnaround -- the biggest since June 2012 -- has made it the world’s best performing benchmark, despite a relatively lackluster quarterly earnings season.

After tumbling into a bear market in September, Hong Kong’s stocks have struggled to find a floor. Caught in a U.S.-led tech sell-off, a slump in the yuan, a trade dispute between Beijing and Washington, souring sentiment for emerging markets and one of the worst years ever for stocks in mainland China, the city’s traders have barely had a moment of calm. They’ve endured declines exceeding 2 percent for the Hang Seng Index on 14 occasions this year, the most since 2011. Last year, drops of that magnitude happened only twice.

Last week’s better-than-expected results from Tencent Holdings Ltd. had helped improve sentiment, bringing volatility down from the highest level since 2016. The mood was so bearish in October that investors were blindsided by a massive short squeeze at the start of this month, a reminder of how one-directional the market had become.

Tuesday’s losses show how most problems afflicting global investors in 2018 have found a foothold in the Hong Kong. Its largest companies generate the majority of their sales from a slowing China, while the city’s dollar peg ties it to tightening U.S. monetary policy.

Other index and stock moves:

- Tencent, Sunny Optical Technology Group Co., AAC Technologies Holdings Inc. among worst performers on HSI with a drop of at least 3%, while a measure of tech companies falls by the most on Hang Seng Composite Index

- CSPC Pharmaceutical -6% even after analysts remain bullish following 3Q results; Sino Biopharmaceutical Ltd. -3.6%

- Shanghai Composite -1.6%, Shenzhen Composite -1.8%

- Hangzhou Hikvision Digital Technology Co. tumbles 7.6% in Shenzhen as U.S. mulls export ban on AI tools