* Bad loans on the rise at Asian banks in Q2

* Even banks with no direct Chinese exposure are hurt

* Slowdown seen hitting commodity credit in particular

By Lawrence White

HONG KONG, Aug 12 (Reuters) - Asian lenders are seeing their loan books rapidly deteriorate across the region as China's slowing economy dampens trade and hurts companies that had borrowed heavily from the banks.

Among 23 major non-Chinese lenders, all but 6 reported an increase in soured loans in the first half of 2015, the strongest indication yet of how China's slowdown is infecting banks' balance sheets, data compiled by SNL Financial for Reuters show.

That trend accelerated in the second quarter, the banks' data show.

"Second-quarter results have seen banks across Asia suffer rising bad loans after a period of historic lows in NPL levels," said Josh Klaczek, JPMorgan (NYSE:JPM) head of Asia financials research.

"China's slowing growth has particularly hit shorter duration trade-related loans, but is likely to have a broader impact on commodity credit, given its importance as an end-user."

The data indicate how banks regionwide are suffering even when, like in Indonesia, they are not lending much directly to Chinese companies, as trade across Asia stutters.

Indonesian banks saw provisions against bad loans as much as triple in the first half of 2015.

"Most of the Indonesian banks said their increasing non performing loans (NPLs) are because of the mining and construction sectors, which have been hit the most by slowing demand from China," said analyst Syaiful Adrian at Ciptadana Securities.

The world's No.2 economy is officially targeted to grow at 7 percent this year, but some economists believe it is expanding at a slower pace. Data this month showed Chinese producer prices hit their lowest point since late 2009.

Singapore's banks, which had boosted their China credit, were this year hit by a drop in billions of dollars of China trade financing deals as mainland borrowing conditions eased while offshore interest rates widened.

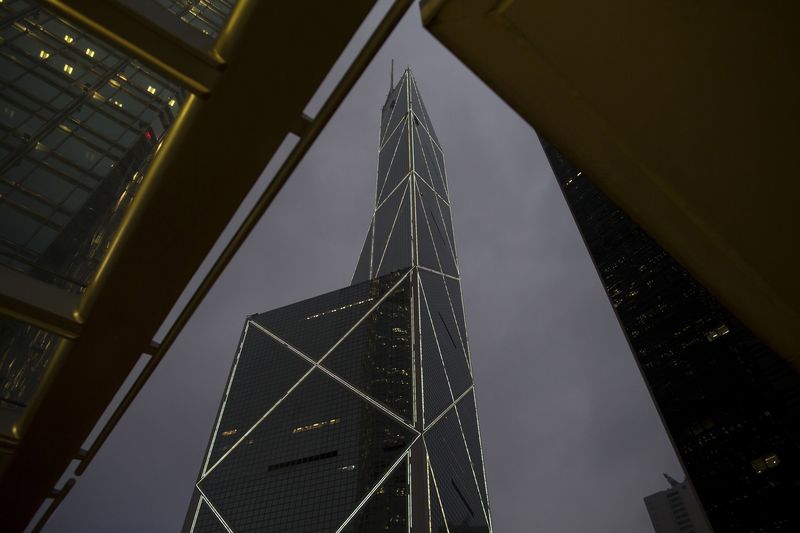

Hong Kong's Bank of East Asia 0023.HK said impairment losses had more than doubled to HK$782 million ($100.83 million) in the first half and warned its outlook looked challenging amid China's slowdown and a stock market plunge.

In Thailand, bad loans at commercial banks rose in the second quarter to their highest level since 2012, hit by a slowdown of Thai exports, especially to China.

Mike Smith, CEO of Australia and New Zealand Banking Group ANZ.AX , played down on Tuesday concerns despite a 13 percent rise in bank bad debt charges: "Is it going to get significantly worse? I don't think so." ($1 = 7.7557 Hong Kong dollars)