(Bloomberg) -- President Donald Trump’s advisers are scrambling to explain a trade deal he claimed he’d struck with China to reduce tariffs on U.S. cars exported to the country -- an agreement that doesn’t exist on paper and still hasn’t been confirmed in Beijing.

In the day after Trump announced the deal in a two-sentence Twitter post, the White House provided no additional information. Meanwhile, China hasn’t formulated its response because bureaucrats are awaiting the return home of President Xi Jinping, according to three officials who were briefed but declined to be named as the matter isn’t public.

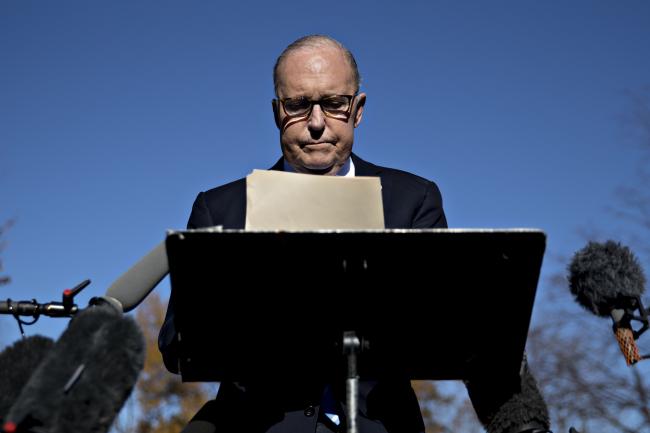

Questioned about the agreement on Monday, Treasury Secretary Steven Mnuchin and Trump’s top economic adviser, Larry Kudlow, dialed back expectations and added qualifiers. Xi is scheduled to visit Portugal on Tuesday and Wednesday before heading back to Beijing.

Monday’s global stock market rally showed signs of fading on Tuesday as uncertainty over the status of the deal set in. Still, the onshore yuan extended its biggest advance in more than two years.

“I’ll call them ‘commitments’ at this point, which are -- commitments are not necessarily a trade deal, but it’s stuff that they’re going to look at and presumably implement,” Kudlow told reporters at an official White House briefing on Monday that followed TV interviews and informal briefings by him and Mnuchin earlier in the day.

The apparent move on auto tariffs was part of a broader trade truce struck by Trump and the Chinese president during a dinner in Buenos Aires on Saturday night. As part of that the U.S. said it had agreed to hold off on raising tariffs Jan. 1 while negotiations took place. Kudlow initially said that the Chinese had 90 days from Jan. 1 to come up with "structural changes" regarding intellectual property protections, forced technology transfer and other issues.

The White House later corrected him to say that the 90 days actually began on Dec. 1, Saturday.

Trump’s tweet, which moved stocks of automobile companies across the globe, followed the dinner at the Group of 20 summit in Argentina. There, all sides agree, the American president consented to postpone an increase in tariffs on Chinese imports to 25 percent from 10 percent, which was scheduled to take effect Jan. 1, in exchange for negotiations on broader economic disputes.

“I think there is a specific understanding that we are now going to turn the agreement the two presidents had into a real agreement in the next 90 days,” Mnuchin told reporters at the White House on Monday. “I’m taking President Xi at his word, at his commitment to President Trump. But they have to deliver on this.”

He didn’t say precisely what China committed to do.

The uncertainty underscored the risk entailed by Trump’s eagerness to strike deals without nailing down details in advance. The confusion was exacerbated by the absence of a joint statement from the U.S. and China following the dinner. Financial markets were left struggling to digest talks that the White House portrayed as a major victory for the president.

“That’s what happens when you don’t have the detailed negotiations going into the summit” and end up with the “broad swath of a 35,000-foot deal,” said Bonnie Glaser, a China expert at the Center for Strategic and International Studies in Washington. “It’s risky. There’s certainly no guarantees that it will produce the outcomes that we want.”

Officials in Beijing did not respond to requests for an explanation and neither did the Chinese embassy in Washington.

Trump nevertheless praised himself for the dinner, and abandoned nuance in claiming on Twitter that China had agreed to immediately buy more U.S. farm products, in addition to dropping car tariffs. Mnuchin, in an interview with CNBC on Monday, put a $1.2 trillion price tag on China’s additional trade commitments, but emphasized the details of how they get there still need to be negotiated.

China imposed a retaliatory 25 percent tariff on imports of cars from the U.S. over the summer in response to Trump’s own tariffs. That’s added on top of a 15 percent tariff that Beijing charges for imports from the rest of the world, leaving U.S. auto exporters facing a 40 percent levy at the Chinese border.

In his briefing with reporters, Kudlow said he assumed that the Chinese would eventually drop their auto tariffs altogether. Such a change would have to apply to all countries under World Trade Organization rules.

“We don’t yet have a specific agreement on that,” Kudlow said, apparently contradicting Trump’s tweet on the matter. “But I will just tell you, as an involved participant, we expect those tariffs to go to zero.”

Asked why the auto tariffs weren’t mentioned in statements the U.S. and China issued after the dinner, Kudlow inexplicably insisted that they were. “I don’t agree with that,” he said.

(Adds China in second paragraph and markets in fourth paragraph.)