(Fixes typo)

SYDNEY, Feb 18 (Reuters) - Australian Prime Minister Malcolm Turnbull has rejected a call from his government backbench to exempt the county's big four banks from a tax package aimed at reducing company tax rate from 30 percent to 25 percent.

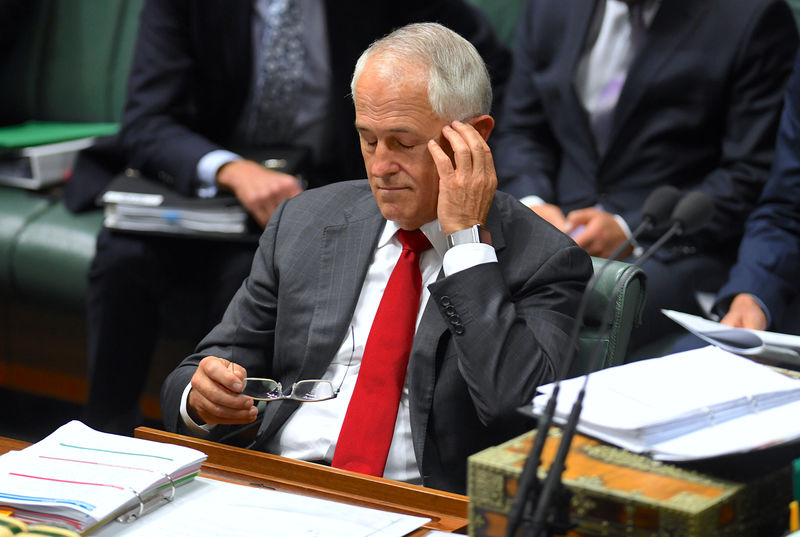

Speaking to reporters in Queenstown, New Zealand on Saturday, Turnbull insisted that a company tax cut has to be applied without exemption.

"A company tax rate has got to really go across all corporations," Turnbull said.

"Distinguishing between one sector and another is not a practical measure. I'm not aware of that ever being done in any other jurisdiction."

Bankbench anger about Australia's highly profitable banking sector has been stoked in recent times by a series of damaging scandals that have raised questions about probity and culture at Australia's big four retail banks, which last financial year reported a combined net profit of $29.65 billion. top banks are the Commonwealth Bank of Australia CBA.AX , Westpac Banking Corp WBC.AX , Australia and New Zealand Banking Group ANZ.AX and National Australia Bank NAB.AX .

Following release of the report "Financial Advice: Fees for no service" by the Australian Securities Commission and Investments Commision (ASIC) in October 2016, it emerged that Westpac, the ANZ, NAB and the Commonwealth Bank had been ordered to return $178 million in refunds and compensation to customers who had been unfairly billed for financial advice.

The reputational damage incurred by the advice scandal has been compounded by revelations of interest rate rigging and the consistent refusal of the major banks to pass on to consumers official rate cuts in their entirety.

In addition, some backbenchers argue that Australia's banks, whose profits are heavily geared to real estate and the domestic economy, are largely insulated from the kinds of global economic shocks which can seriously harm other industries.

Turnbull on Saturday also reiterated his opposition to a banking Royal Commission, saying the government's proposed one-stop shop financial services ombudsman would be able to deal fairly with disputes between consumers and financial services providers.