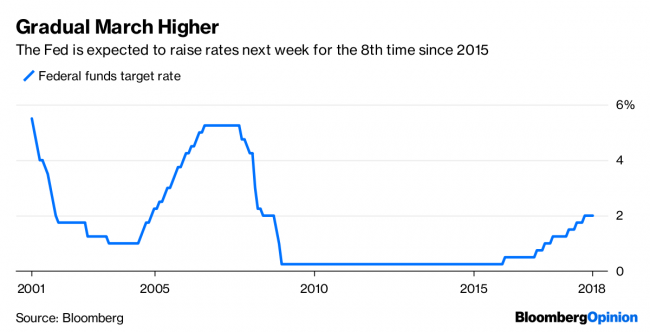

(Bloomberg Opinion) -- Most every market participant expects the Federal Reserve to raise interest rates another quarter percentage next week, the eighth increase since December 2015. And despite speculation the central bank may be close to slowing the pace of hikes, the reality is that while any changes to the Fed's Summary of Economic Projections would be modest, they would likely reveal a more hawkish than dovish tilt.

There are two central questions to consider. The first is how is the economy performing relative to expectations? I don’t think anyone at the Fed believes the economy’s performance is subpar. In fact, some policy makers such as Cleveland Federal Reserve President Loretta Mester clearly believe the economy is sustaining greater momentum than expected, with growth seen hovering around the 3 percent mark. According to the Federal Reserve Bank of Atlanta, the third quarter could be a repeat of the second quarter with growth exceeding 4 percent.

The fact that no one will likely revise their economic growth forecasts down while some may revise them higher means that the risk is weighted to an upside surprise in the median projection for gross domestic product. My expectation is that domestic factors will outweigh international concerns for the time being in terms of growth outlook. Moreover, an upside surprise to the GDP forecast suggests the possibility of a lower unemployment rate estimate. Wages rose 2.9 percent in August from a year earlier, a high for the current cycle and reinforcing the view that the economy is operating at least at full employment if not beyond.

The risk of upward revisions to the growth forecast, downward revisions to the unemployment forecast and a stable estimate of the neutral unemployment rate all point to a risk that the inflation forecast may be raised as well. The reasons for that include an escalating trade war with China and a Fed staff that seems increasingly biased toward inflation concerns.

The second central question is how have financial conditions evolved since the Fed began raising policy rates? Measures produced by the Federal Reserve Banks of Chicago and St. Louis indicate that financial conditions have eased markedly since the Fed began boosting rates in December 2015. Fed Governor Lael Brainard recently identified easy financial conditions as an indication that short-term neutral rates were rising along with policy rates such that the Fed had actually not tightened policy as much as believed.

Put it all together and it looks very unlikely that the Fed will deliver a dovish message next week. Policy makers may say they are keeping a close eye on international issues such as trade wars and emerging-market distress, but until these issues bleed over into the U.S. economy more broadly, they will remain a sideline issue for the central bank.

Also consider that even with the escalating trade war with China, it may be that Fed forecasts are too pessimistic. Although this week the Organization for Economic Cooperation and Development downgraded its 2018 U.S. growth forecast to 2.9 percent from 3 percent, that's still a touch higher the Fed’s 2.7 percent expectation. For 2019, the OECD expects 2.7 percent growth, compared to the Fed’s 2.4 percent. Remember, these numbers are in comparison to the 1.8 percent that the Fed believes is consistent with stable growth over the longer run.

So even with tariff threats, we are still looking at numbers that would tend to keep the Fed on a tightening path. To be sure, should circumstances change markedly that places the forecast into a very different light, the Fed will adjust.

Fed Chairman Jerome Powell and his fellow policy makers remain primarily focused on a domestic economy that holds substantial momentum as the fourth quarter approaches. At best, the message from the Fed is neutral relative to the June SEP report and press conference. The risk, however, is that the Fed’s message is on the hawkish side, including an upward shift at the lower end of rate projections that doesn't necessarily imply a faster pace of hikes, but more confidence that the gradual pace of increases will extend deep into 2019.

To contact the editor responsible for this story: Robert Burgess at bburgess@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

©2018 Bloomberg L.P.