(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

The European Central Bank’s latest round of stimulus is being accompanied by renewed calls on governments to step up their game in nurturing the economy.

It’s an acknowledgment by President Mario Draghi and fellow policy makers that they’ll do what they can -- but their options are sorely depleted if the current economic weakness worsens.

That puts the focus on reforms to make economies more resilient, and even fiscal stimulus, despite high debt in a number of countries. It’s a long-running refrain, but Peter Praet, chief economist at the institution, this week put it simply: “Monetary policy remains effective but cannot be the only game in town.’’ Draghi’s comments on the topic at his most recent press conference were also longer than usual.

Euro-area growth this year is forecast to be the weakest since 2013, and inflation remains subdued, despite record-low interest rates and 2.6 trillion euros ($2.9 trillion) in asset purchases. Germany’s Ifo institute sees Europe’s largest economy growing just 0.6 percent this year, almost half the pace it previously predicted.

The ECB’s pledge last week to offer more cheap funding to ensure credit keeps flowing to companies and households came with couched criticism that governments aren’t heeding advice from Brussels on how to boost productivity and growth potential.

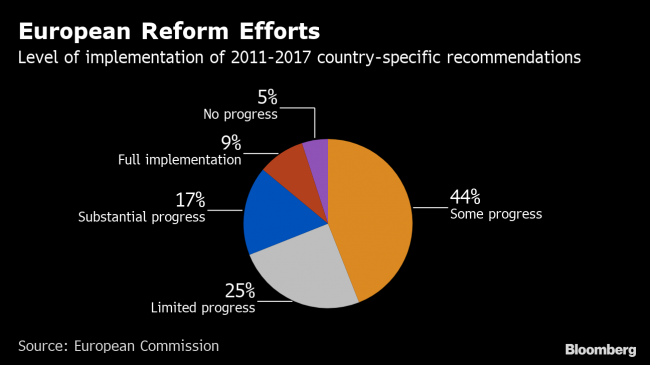

Draghi was as close to scathing as central bankers can be when describing how countries have implemented recommendations from the European Commission. Progress has been “scant, or not much, at best.’’

His comments echo points made by other institutions. Earlier this month, the OECD said the region would be best served by “coordinated action, involving fiscal support and renewed structural-reform efforts.’’ The IMF has previously urged Europe to address its “deep structural challenges.’’

Should the euro-area economy deteriorate, the ECB’s means of response are limited. Self-imposed rules on asset purchases mean little room to restart QE, and concern over the side effects of negative interest rates makes further cuts unlikely.

Bundesbank President Jens Weidmann has said a fiscal-policy reaction would be needed if there’s an economic shock. His Austrian colleague Ewald Nowotny sees a need to “think more strongly about the relationship, and the combination of monetary policy and fiscal policy.’’

But governments have little room to spend. Debt levels in all but a few member states far exceed European Union rules after years of crisis-fighting. All the more important are efforts to address structural hurdles blocking more dynamic growth.

Last year, the Commission’s reform recommendations covered a range of policy areas -- from four in Luxembourg and Malta to 19 in Italy, a key source of concern. On top of that came an appeal to reduce macroeconomic imbalances.

“A proper fiscal policy could actually help not only the recovery, not only the convergence of inflation to our objective path, but also on the issue of external surplus,’’ Draghi said on March 7. “Even though we may be convinced that it’s right, we also have to be aware that we are not the ones who implement these decisions.’’

(Updates with Ifo forecast in fourth paragraph.)