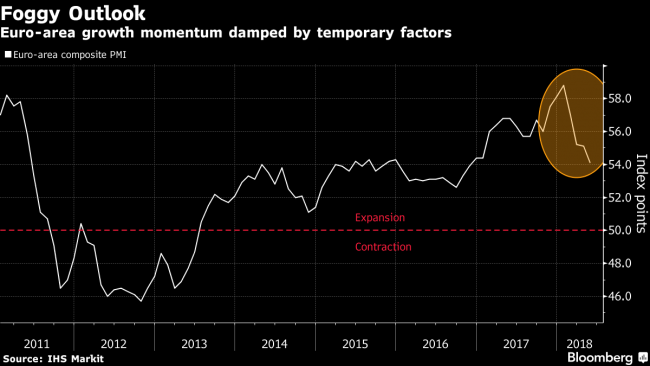

(Bloomberg) -- Economic momentum in the euro area cooled yet again in May as more temporary factors weighed on output in manufacturing and services.

A composite Purchasing Managers’ Index fell to an 18-month low of 54.1, from 55.1 in April, IHS Markit said on Wednesday. New order growth weakened, hiring and backlogs of work showed slower rates of increase and companies became less optimistic about the outlook.

“While prior months have seen various factors such as extreme weather, strikes, illness and the timing of Easter dampen growth, May saw reports of business being adversely affected by an unusually high number of public holidays,” said Chris Williamson, chief business economist at IHS Markit. “Some of the fog will hopefully lift with the June PMI data, providing a clearer signal of the underlying growth momentum.”

European Central Bank officials are carefully watching economic reports from across the 19-nation region as they prepare to set out the future path for monetary policy. Asset purchases are currently set to expire in September, although they could be extended if the growth and inflation outlook warrants further stimulus.

Preliminary PMI data for June will be published on June 22, a week after the Governing Council holds its next policy meeting. Officials have indicated in the past that they saw scope to wait until July to decide on their bond-buying program.

Williamson said that activity in euro-area manufacturing and services signals the economy is currently expanding at a quarterly pace of just over 0.4 percent. That would match first- quarter growth but remains below the rates seen in 2017.

“It’s also becoming increasingly evident that underlying growth momentum has slowed compared to late last year,” Williamson said. “More expensive oil and rising wages are meanwhile continuing to push companies’ costs higher, but weak final demand means firms are struggling to pass these higher costs onto customers.”