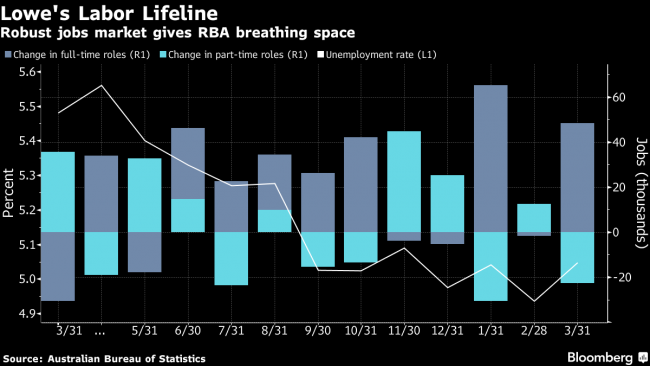

(Bloomberg) -- Australian employment climbed more than expected in March, led by full-time roles, suggesting the central bank has more time to assess whether the economy needs further stimulus.

Key Insights:

- While unemployment has been hovering around 5 percent, it’s failed to tighten the labor market sufficiently to drive the faster wage growth policy makers are seeking to return inflation to its 2-3 percent target

- The jobs market has been a key factor in the Reserve Bank’s resistance to resuming interest-rate cuts after a 2-1/2 year hiatus. It’s waiting to see how the current disconnect between strong hiring and low unemployment and slowing economic growth plays out

- Should employment hold up, the RBA will be able to maintain its room for maneuver, particularly given the government and its main opposition are offering fiscal stimulus via tax cuts, cash rebates and additional spending ahead of a May election

- However, if employment shows consistent weakness -- one poor reading is likely to be insufficient given the data’s volatility -- then calls for easing will grow much louder

- Money markets are pricing in a a rate cut as a done deal; tumbling house prices in Sydney and Melbourne have spooked households and cooled consumption, slowing the economy. The Fed’s abandonment of further rate hikes only adds to the case

Market Reaction

- The Aussie dollar rose as high as 71.99 U.S. cents from 71.69 cents pre-data. It bought 71.75 cents at 11:49 a.m. in Sydney