By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar traded sharply lower ahead of this year’s first Federal Reserve monetary policy announcement. Softer-than-expected data contributed to the weakness but more importantly, investors are nervous about President Trump’s push for a lower currency. Without using the word directly, Trump is basically calling for a devaluation of the dollar. At the start of the week, the president vowed to include a clause preventing currency manipulation in all future bilateral trade deals and on Tuesday morning, one of his trade advisors said that Germany is using a “grossly undervalued” euro to exploit US and EU partners. The new president is taking the U.S.’ global trade partners head on and no one, regardless of their importance as an ally, is spared. By pressuring other countries to boost their currency, he is hurting the U.S. dollar and even a hawkish Fed may not be able to save the currency as Trump jawboning overshadows Fed tightening.

While the Federal Reserve is not expected to raise interest rates on Wednesday, investors will be looking to the FOMC statement for reassurance that rates will rise again this year. When they last met, the dot plot forecast showed policymakers looking for 3 hikes in 2017. At the time, Fed Chair Janet Yellen described the extra quarter-point hike as a “very modest adjustment.” Although the dot plot won’t be updated and we will not be hearing from Janet Yellen, any upgrades to the economic outlook/assessment will be perceived as positive for the dollar and could drive USD/JPY back to 114. We don’t anticipate an extended rally as 115 caps gains in the near term. However if the FOMC statement contains even a hint of greater concern, the dollar could fall quickly and aggressively, which would support the current dollar-negative sentiment. There’s no question that USD/JPY will have a larger reaction to a less-hawkish FOMC statement than a more hawkish one. Currently, Fed Fund futures show investors looking for another rate hike in the summer and despite all of the volatility caused by Trump, the market is pricing in a 71% chance of a 25bp rate hike in June, which is about the same as the odds at the beginning of the year.

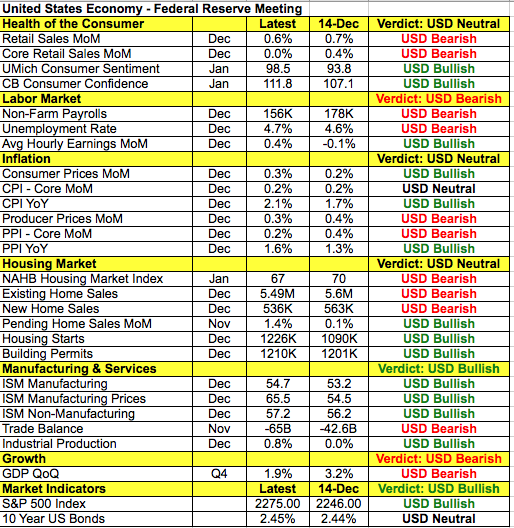

Taking a look at the table below, there’s been just as much improvement as deterioration in the U.S. economy since the December Fed meeting, which means there are reasons for policymakers to be less optimistic. Retail sales growth slowed in December with spending ex autos and gas stagnating. Nonfarm payrolls rose only 156K last month, pushing the unemployment rate up to 4.7%. There is good news, however, with confidence and earnings up, inflation on the rise and activity in the manufacturing and service sectors gaining momentum. In light all this, the central bank could also opt to leave the FOMC statement virtually unchanged, which would probably hurt the dollar.

Tuesday's best-performing currency was the euro, which climbed to its strongest level versus the greenback in more than a month. Tuesday’s rally took the currency pair to 1.08, an extremely important resistance level that EUR/USD could struggle to break. German Chancellor Merkel refused to engage with Trump on the issue of the currency but U.S.-German relations will suffer from Trump’s attack on the currency. In a speech on Tuesday, Merkel said, “we can’t change the situation with respect to monetary policy and Germany cannot influence the euro rate.” And yet Trump’s call for a stronger euro is positive for the currency and helped to drive it higher on Tuesday. Stronger Eurozone and softer U.S. data also contributed to EUR/USD’s run to 1.08. Although German retail sales missed projections by posting a -0.9% decrease in activity when an increase of 0.6% was expected, German unemployment numbers fell -26k and the unemployment rate for the region dropped to 5.9%. The unemployment rate for the Eurozone as a whole improved to 9.6%, slightly better than the 9.8% expected. GDP for the fourth quarter in the Eurozone posted an increase of 0.5%, besting the 0.4% forecasted. Eurozone Estimated CPI (YoY) continued to rise reaching 1.8% in January, up from 1.5% expected. Core CPI was in line with expectations, posing a 0.9% increase. There are no major Eurozone economic reports scheduled for release on Wednesday but the election in France is a growing focus amid the leading conservative candidate's fraud campaign. If EUR/USD breaks above 1.08, the next stop will be the December spike high of 1.0875.

Sterling also performed well, recovering all of its earlier post-data losses. As reported by our colleague Boris Schlossberg,

Sterling fell hard in morning London dealing today after a series of UK credit reports missed their mark. The pair was down nearly 100 points off its highs dropping to a low of 1.2412 before finding a modicum of support. A series of UK credit reports showed that UK consumers are starting to retrench. Mortgage approvals missed printing at 67.9K versus 69K. Consumer credit came in at 1.3B versus 1.7B eyed and money supply actually contracted by -0.5% versus forecasts of 0.3% rise. UK consumers are clearly starting to feel reticent ahead of the looming Brexit vote and spike in costs due to a lower pound may also be cutting into demand for credit as confidence wavers.

However Wednesday’s U.K. manufacturing PMI numbers should help the currency as the rise in the Confederation of British Industry’s Total Trends survey points to a stronger report. We continue to look for sterling to outperform, especially on the back of the Bank of England’s Quarterly Inflation report.

All 3 of the commodity currencies traded lower against the greenback Wednesday. The Canadian dollar benefitted from better-than-expected November GDP data, which saw growth rising 0.4%, slightly better than the 0.3% forecast. In addition, oil prices ticked up as OPEC nations successfully cut close to 1 million barrels of production this month. AUD was supported by higher gold prices but slipped a bit following softer manufacturing PMI. The index dropped from 55.4 to 51.2 in January. The currency remains in play ahead of Chinese manufacturing reports. The New Zealand dollar traded higher against the greenback for most of the day but gave up some of its gains after a softer employment report. The country’s unemployment rate jumped to 5.2% as employment change slowed to 0.8% in the fourth quarter. Although part of the improvement was driven by a higher unemployment rate, wage growth dropped 0.3% in the fourth quarter, which was a big miss compared to the market’s 0.6% forecast.